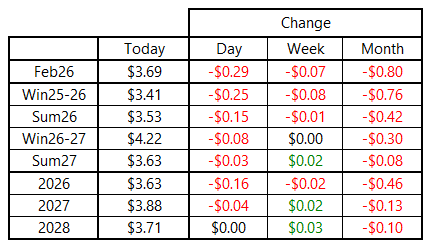

Natural Gas Market Note | 12.31.2025

Futures drop sharply with cold expected to end quickly.

Natural gas prices finished 2025 on a down note, with futures across the curve plunging lower as the market eyed a quick end to the current cold snap. The February 2026 contract lost nearly 30 cents on the day, bringing the prompt-month continuation to its lowest level since October. The two-month balance-of-winter strip remains about 20 cents above its December low, finishing today at $2.41 per MMBtu.

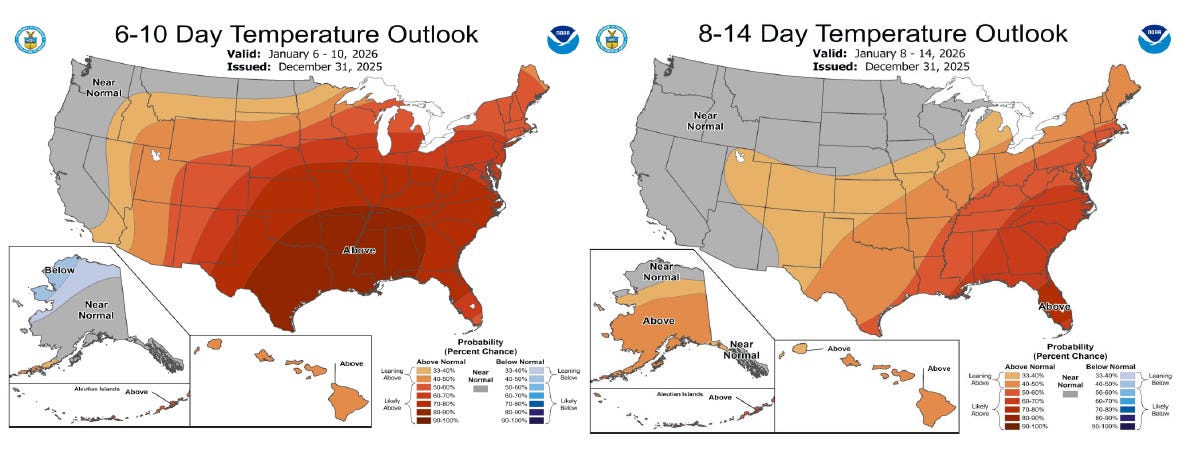

Today’s bearish sentiment was initially driven by major warm shifts for the eastern half of the U.S. in both the 6–10-day and 11–15-day outlooks. While population-weighted heating degree days are expected to remain elevated for the next five days, the market is looking past the immediate term and focusing on a significant warmup expected beyond the first week of the New Year.

When the EIA’s storage report was released at noon Eastern, it did nothing to alter the market’s downward momentum. The announced 38-Bcf draw marked a dramatic shift from the previous three reports, which all showed much larger-than-average withdrawals. This report reflected an especially mild week that also included the Christmas holiday. As a result, inventories flipped back to a surplus versus the five-year average while gaining significant ground against the year-ago benchmark.

An archive of Daily Natural Gas Market Notes can be found here.