Natural Gas Market Note | 12.11.2025

Pricing continues to plunge lower despite impending cold snap.

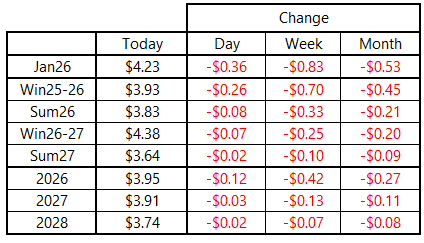

Natural gas resumed its steep decline today, with the January 2026 contract again leading the way lower with a loss of $0.36 per MMBtu. January finished today at $4.23 per MMBtu, down more than $1.25, or about 25% from the intraday highs near $5.50 per MMBtu that traded less than a week ago. The balance-of-winter strip has now wiped out all of its November gains and finished today below $4.00 per MMBtu for the first time since October 30. Today’s losses spread deeper across the curve as well, although to a lesser degree. Summer 2026 lost just 8 cents today, with Winter 2026-27 dropping by a similar magnitude.

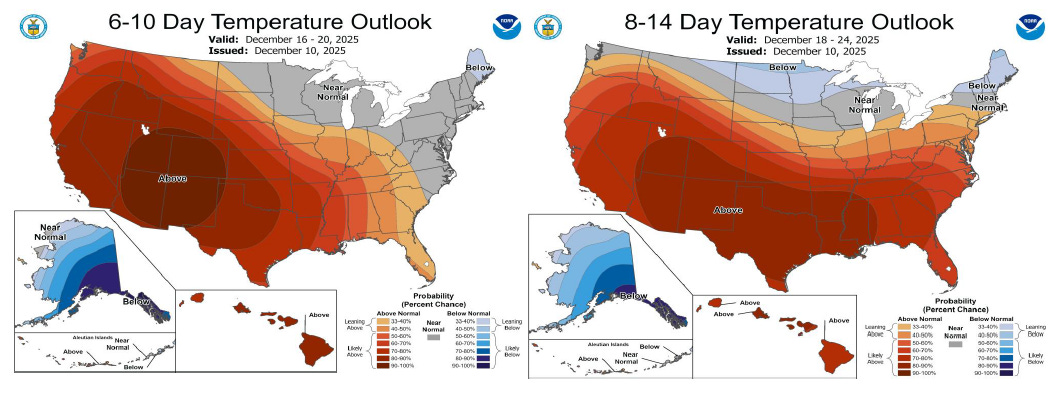

After bullish sentiment reached a fever pitch last week, it is now fair to ask whether the pendulum has swung too far in the other direction. If last week’s sharp gains were about building in the possibility of a strong winter without respite, current pricing would suggest that the market is starting to write off seasonal risk altogether. However, we are still at the very beginning of the winter season, and the setup for major cold snaps to recur is very much still in place, with arctic air looming just above the Canadian border.

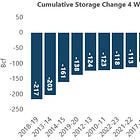

Today’s storage report came in about as expected with a draw of 177 Bcf for the week ended December 5. The market barely seemed to take notice as the surplus to the five-year average was cut nearly in half. With the next two reports also expected to show outsized draws, inventories will very likely be looking up at that benchmark before the end of the year.

If the storage cushion is indeed erased with the two most volatile winter months still ahead, upside risk will remain prominent. Of course, if the second half of December is a preview of what to expect for January and February, there is plenty of downside to be realized as well.

An archive of Daily Natural Gas Market Notes can be found here.