Natural Gas Market Note | 12.04.2025

Prompt-month gas surges above $5.00 per MMBtu as weather models extend cold.

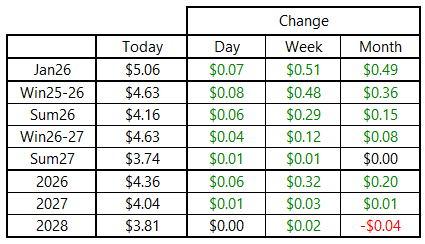

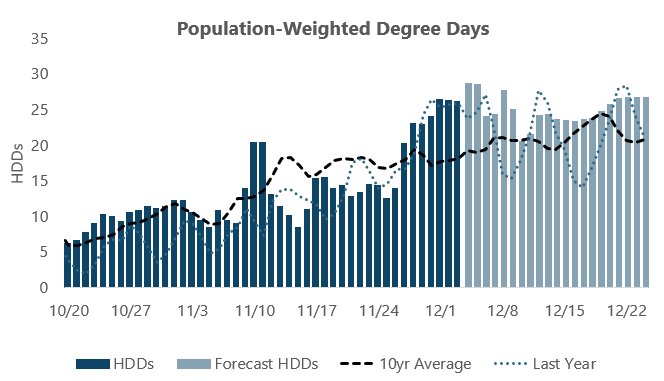

Prompt-month natural gas futures pushed higher today, clawing back early-session losses and finishing the day above $5.00 per MMBtu. Prices opened the day lower, but the market began pushing back to the upside following the EIA storage report that showed another small withdrawal from underground inventories. Bullish sentiment got another boost midday as model runs continued to confirm cold weather extending into the second half of December.

Like yesterday, gains were spread fairly evenly through Summer 2026. The market appears to be bracing for the possibility that a cold winter leaves inventories at a deficit, which would have consequences for next summer and beyond. Summer 2026 finished the day at $4.16 per MMBtu, which is the highest level since July and less than 30 cents off of the 2025 annual high.

Today’s storage report was largely inconsequential to the market. The 12-Bcf draw was virtually in line with the storage change from the previous week, but it worked to narrow the deficit to year-ago inventories and expand the surplus to the five-year average.

Next week’s report will show the first substantial storage withdrawal of the season. Residential and commercial demand combined today to exceed 60 Bcf according to preliminary estimates. Tomorrow’s demand is likely to be even higher before temperatures moderate to some extent going into the weekend. The 60-Bcf-per-day threshold was only exceeded a handful of times last winter and not until early January. This early cold snap is helping to fuel fears of a frigid season overall and keep market pricing elevated even in the face of record production.

An archive of Daily Natural Gas Market Notes can be found here.