Natural Gas Market Note | 11.26.2025

Natural gas pushes higher ahead of the impending cooldown.

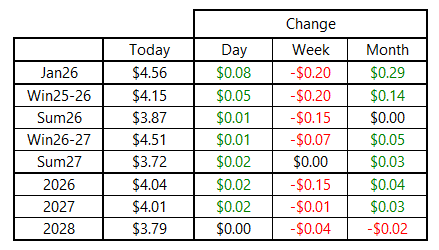

After giving up ground yesterday ahead of the December NYMEX expiration, natural gas futures were back on the rise. Contracts deliverable through the remainder of winter gained back a portion of yesterday’s losses as the remainder of the curve remained relatively flat. Deliveries for Summer 2026 and beyond have been notably quiet in recent weeks, with the vast majority of market volatility focused in the Balance-of-Winter Strip.

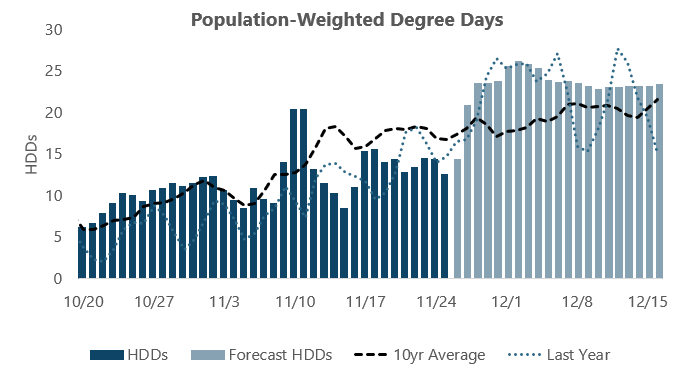

It is somewhat surprising that the market didn’t post stronger gains today given that temperature forecasts pushed colder yet again overnight, and the EIA storage report showed a drawdown in inventories amid a relatively mild week. Since last week, we’ve seen HDDs for early December revised higher. Previous outlooks showed a brief warmup beyond this weekend’s cold snap, but the current forecast now shows the coldest days on December 1–5. While weather is expected to moderate beyond that, expectations still point to cooler-than-normal conditions on average through mid-month.

Despite today’s rally, contracts through March 2026 ended the day still down about $0.20 per MMBtu from week-ago levels. The lack of additional upside even as cold weather forecasts intensify suggests that the market has already priced in a cold start to December. Unless near-term outlooks soften substantially, the price direction going forward likely hinges on how forecasts develop beyond the two-week period. If the second half of December looks to have a cooler-than-normal bias, there is still further upside risk in the market. On the other hand, if near-term cold disappoints or models begin to show a pattern flip back to mild near the middle of the month, some of the premium could be let out of the curve.

Today’s storage report showed an 11-Bcf draw from inventories. Early indications pointed to a net build for this report, but as more fundamental data was gathered prior to the release, some analysts started calling for a net draw. Preliminary fundamental data also indicated a likely net injection for the report week, so the fact that storage declined implies that the actual balance was tighter than suggested by early estimates. This could mean that the record high production volumes were overstated, heating needs were underestimated, or some combination of the two.

An archive of Daily Natural Gas Market Notes can be found here.