Natural Gas Market Note | 11.14.2025

Prices finish higher on the week, recovering impressively from early Friday losses.

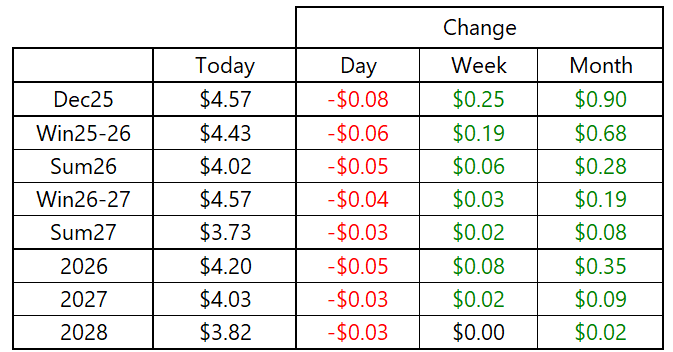

Gas futures finished lower today, giving up a portion of the week’s gains but still posting the fourth consecutive week of rising prices. The market looked poised for steep losses at points on Friday, but demonstrated resilience in the face of a bearish storage report and ahead of two weeks of mild temperature patterns. December again outpaced the rest of the winter strip, gaining 25 cents on the week compared to 19 cents for the 4-month package. Weekly gains were much more marginal beginning with the Summer 2026 strip and diminishing further for longer-dated contracts.

The market showed resilience today, finishing well off of the intraday lows. For reference, December traded as low as $4.376 before posting a daily settlement about $0.20 per MMBtu higher. The market was dealt with an onslaught of bearish news that ultimately failed to lead to a substantial pullback, including warmer near-term weather revisions and the 45-Bcf storage build announced by the EIA at 10:30am eastern. The storage number came in stronger than expected and built further onto the surplus to the five-year average.

However, traders remain much more focused on seasonal temperature risk, as longer-term forecasts continue to zero in on a colder-than-normal winter through the peak months. Cold risk looks to be amplified once the calendar reaches December, and models point to a continued cool bias across most of the northern tier of the country through at least January. Forecasts beyond the next two weeks are historically inaccurate, but the market seems to be taking the consensus seasonal outlooks seriously until proven otherwise.

An archive of Daily Natural Gas Market Notes can be found here.