Natural Gas Market Note | 02.19.2026

Futures pricing continues to drift sideways surrounding the storage report.

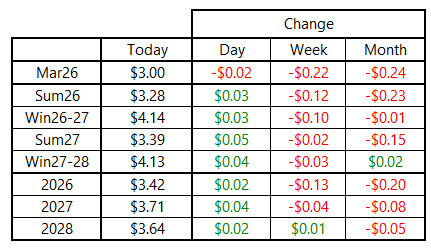

Natural gas pricing was nearly flat on Thursday, continuing the trend of very limited volatility. The March 2026 contract was less than 2 cents lower to finish just below the psychologically important $3.00-per-MMBtu level. This is far from a decisive break below support, however, and so far the market is not treating this as a major sell signal. Beyond the front of the curve, prices edged higher on the day, with the most substantial gains deeper across the curve, as Calendar 2027 added $0.05 per MMBtu on the day.

The most significant fundamental news of the day came in the EIA storage report, which showed a net withdrawal of 144 Bcf for the second week of February. The draw came in lighter than consensus expectations, which helped pull pricing down from its intraday highs posted this morning before the report. This allowed inventories to pull closer to five-year average and year-ago levels, as the deficit to each of those benchmarks was narrowed.

Upcoming weeks are expected to see even slimmer pulls from underground inventories. Based on mostly mild weather forecasts for the balance of the winter season, inventories are now expected to find a bottom north of 1.8 Tcf in March before the onset of net injections. This would put stocks virtually in line with historical benchmarks heading into the summer.

An archive of Daily Natural Gas Market Notes can be found here.