Natural Gas Market Note | 10.30.2025

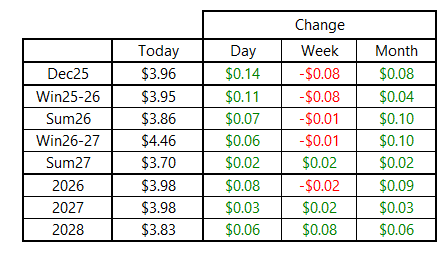

Prices rally with December now on the front of the forward curve.

An archive of Daily Natural Gas Market Notes can be found here.

Natural gas futures were higher across the board today, with December 2025 leading the way and posting the steepest gains as the new prompt-month contract. The rally came despite a storage report that showed an “as-expected” build of 74 Bcf, which kept inventory levels at a relatively steady surplus to year-ago and five-year average stocks.

Gains were muted early in the day, but the market picked up bullish momentum throughout the afternoon without a clear catalyst. Winter futures pricing had been down sharply for 3 straight days, and today’s rally still left pricing well off of Monday’s highs and lower than week-ago levels. Deliveries for next summer and beyond finished this afternoon virtually flat to year-ago levels, with a steep contango still intact through Winter 2026-27.

LNG export demand came in today at just below 18 Bcf, according to preliminary estimates. With continued outperformance at Plaquemines, which is approaching 4 Bcf per day, and a recent uptick in flows into Corpus Christi, LNG export demand could soon push to 19 Bcf per day, which is certainly helping keep winter futures propped up in the face of mild near-term weather forecasts.

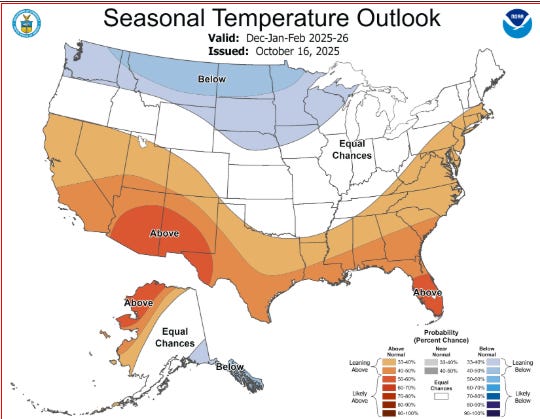

Also contributing to higher forward pricing is uncertainty surrounding winter weather patterns. Seasonal temperature outlooks continue to show an amplified risk of polar vortex-driven cold snaps. Overall, most outlets are calling for a cooler winter than what was observed in 2024-25.

Dec25-Mar26 is currently trading near $3.95 per MMBtu on average. At this point a year ago with similar inventory levels, the Dec24-Mar25 strip was trading near $2.95 per MMBtu, about $1.00 lower than the current winter strip.

Thanks for reading The Energy Buyer’s Guide! Subscribe for free to receive new posts.