The Energy Buyer's Guide | 12.09.2024

Natural gas futures lower despite spot market spikes and elevated demand conditions.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Natural gas futures for the balance of winter moved lower last week, even amid the strongest near-term demand conditions so far this season

- Expectations for milder temperatures in the coming weeks contributed to the bearish market sentiment, with near-term forecasts showing a strong chance of warmer-than-normal weather across key population centers

- Spot natural gas and power prices surged higher in every region of the country last week, with the Northeast experiencing by far the most significant price spikes

- Natural gas storage inventories fell by 30 Bcf during the final week of November and are expected to see a much more substantial drawdown in the EIA report covering the week ended December 6

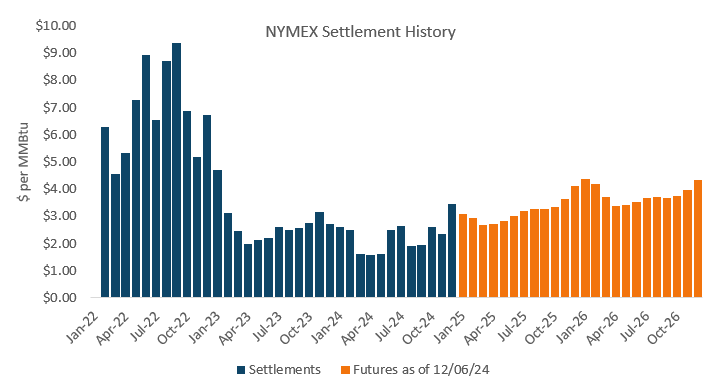

Natural gas futures finished sharply lower last week, with prices continuing to retreat from the late-November highs. The prompt-month January 2025 contract and balance-of-winter strip each lost nearly 30 cents on the week, with all of that weakness experienced on Monday and Tuesday before the market found a level of stability from Wednesday into the weekend. The psychologically important $3.00-per-MMBtu level acted as firm support, standing up to multiple tests as buying interest picked up as the prompt-month contract neared that benchmark. Losses were less substantial further out the curve, with the Summer 2025 strip down just $0.14 per MMBtu on the week and deferred contracts finishing virtually unchanged.

All eyes are on the weather, as fluctuating near-term temperature forecasts continue to inform wide swings in market pricing. Current outlooks show another brief cold shot impacting the market later this week before patterns shift to a period of unseasonably mild temperatures beyond next weekend. According to current outlooks stretching to the end of December, it appears last week’s cold will be the most intense and prolonged for at least the next three weeks, but predictive models have been especially volatile so far this winter, so these forecasts are very much subject to change.

Beyond the weather-related considerations, domestic production remains the most impactful variable on the underlying fundamental balance. Production firmed back to near 102 Bcf per day, representing a significant improvement over the sub-100 levels recorded in early November. However, output continues to hold below year-ago levels by about 2 Bcf per day. Along with expectations for strong underlying demand, this is a primary factor in our forecast for inventories to be drawn down to a deficit to year-ago levels before the end of the season, which should prove supportive for the market in 2025.