The Energy Buyer's Guide | 12.02.2024

Natural gas moves higher, as cold weather sets in over key population centers.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Natural gas futures finished higher during the holiday-shortened week, with NYMEX contracts rising in anticipation of rising heating demand

- Storage inventories declined by 2 Bcf during the week ended November 22 according to last Wednesday’s government report, increasing the surplus to the five-year average ahead of most substantial drawdowns in the coming weeks

- Weather patterns are expected to come in cooler than normal in the Midwest and East for the next week before normalizing in these regions near the end of the 14-day period

- Spot natural gas and power prices were higher across virtually the entire country last week amid a stronger demand environment

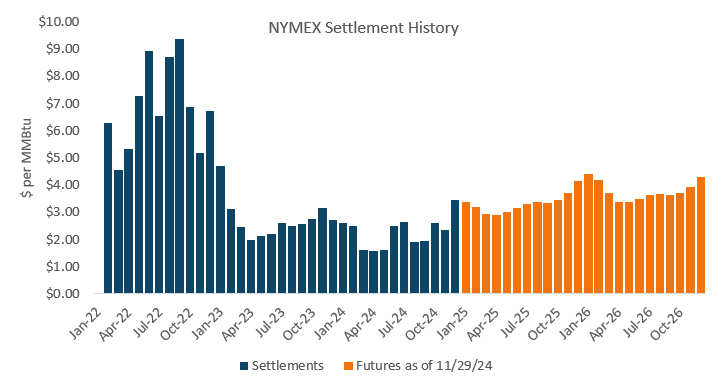

Natural gas prices were higher in a holiday-shortened week as the market anticipated the highest heating demand so far this season. The December 2024 contract expired on Tuesday at $3.431 per MMBtu, representing the highest NYMEX expiration price since the January 2023 contract and an increase of more than $1.00 per MMBtu from the November expiration a month prior. This completed the 2024 NYMEX annual average at $2.269 per MMBtu, which is the lowest since 2020. With January now on the front of the forward curve, the winter strip is down to just three contracts, which were up by an average of $0.07 per MMBtu on the week. Summer 2025 posted similar gains and remains at a slim premium to the balance of winter.

Domestic production continued to increase last week, posting an estimated average north of 102 Bcf per day. Even as volumes remain below year-ago levels, strengthening output alongside rising demand is an encouraging sign as winter ramps up. Temperatures are expected to remain cooler than normal in the Midwest and East for the next 10 days, but recent updates to near-term temperature outlooks show temperatures normalizing near the end of the two-week period across most key population centers.

Given the above, and with prices for the rest of the winter ending last week well off of the lows established in early November, we now believe that the market is adequately pricing in risk for the upcoming three months and are changing our outlook back to neutral for that period. However, we maintain a bullish stance beyond the first quarter, as we still see outsized upside potential due to expectations for lower storage inventories and new LNG export capacity on the way. With a steep premium already embedded in Winter 2025-26 and beyond, we are leaving the long-term outlook as neutral.