The Energy Buyer's Guide | 11.11.2024

Natural gas was flat last week and off to a strong start this morning amid shifting weather forecasts and tighter supply.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Natural gas futures were little changed across the board last week amid mixed fundamental signals, which include a decline in estimated natural gas production

- Storage inventories grew by 69 Bcf during the final week of October and are expected to continue to build for the next two weeks, with stocks potentially exceeding 4 Tcf for just the third time

- Spot natural gas and power prices have been historically low, but these markets will likely be pressured to the upside as temperature patterns cool in the coming weeks and months

- Near-term temperature forecasts remain bearish for the next 10 days, but predictive models are pointing toward more seasonable weather beginning late in the month

Natural gas futures finished little changed after a back-and-forth week of trading. The December contract was up modestly, while the balance-of-winter strip gave up a bit of ground. Monday saw the most volatility, with the market gapping lower last Sunday evening only to recover sharply during the trading day. Prices trended lower from there to finish Friday near week-ago levels. The market is off to a strong start already this week, with a gap higher at open on Sunday, November 10, and futures prices extending gains on Monday morning.

Temperature patterns to start the winter season have been overtly bearish, and near-term forecasts indicate that this will continue for the next 6-10 days. However, recent updates show some fading warmth in the East and cooler-than-normal weather moving into parts of the Midwest during the last week of the month. This, combined with recent estimates showing a drop-off in domestic production, seems to be driving a shift in sentiment even as storage inventories approach 4 Tcf for just the third time on record.

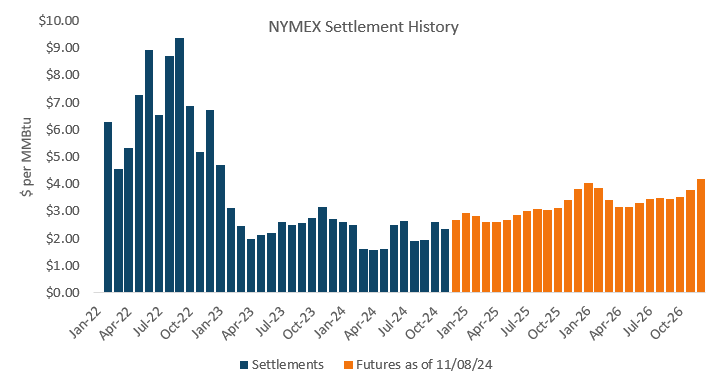

The contrast between near-term bearish conditions and supportive underlying fundamentals has defined much of the natural gas market in 2024, which has been a historically low year for natural gas pricing across the board. However, heading into the winter, uncertainty surrounding the trajectory of domestic supply amid a rising demand environment has helped to stabilize the market and maintain a risk premium across the curve. Higher-than-anticipated storage inventories heading into the winter helps to reduce some of that risk, but a robust withdrawal season would still flip inventories to a deficit by the spring. This would set the stage for more supportive market environment in 2025, especially as new LNG export capacity ramps up during the first half of the year.