The Energy Buyer's Guide | 10.21.2024

Winter natural gas futures plunge to three-year lows ahead of an extended stretch of mild weather.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Natural gas futures were down sharply through the upcoming winter, marking the third straight week of declining prices

- Unseasonably mild temperatures are expected for key population centers for at least the next two weeks, which would limit energy demand at the beginning of the heating season

- Domestic natural gas production was greater than 100 Bcf per day last week for the first time since August, while remaining lower than year-ago levels

- West Coast natural gas basis and power forwards were stronger last week for the upcoming winter, while most of the rest of the nation saw discounted winter risk premiums

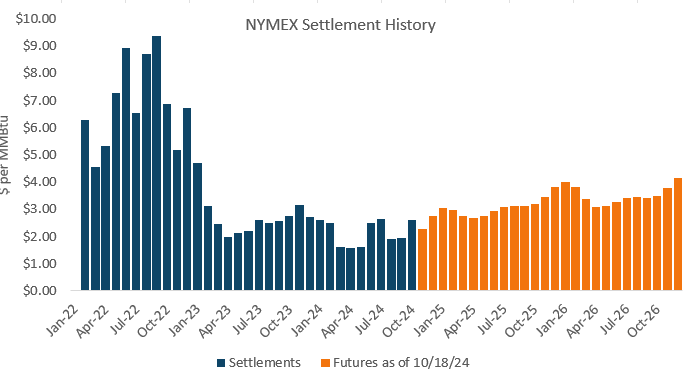

Natural gas futures plunged sharply lower last week, with most of the losses experienced near the front of the forward curve. The prompt-month contract finished on Friday down by 14% from the previous week, while the Winter 2024-25 strip was down by nearly 9%. Most importantly perhaps is the fact that the winter strip was finally able to push below $3.00-per-MMBtu support, with selling interest appearing to pick up after that psychological benchmark was breached early in the week. Winter 2024-25 ended on Friday at its lowest level in more than three years. Meanwhile, Summer 2025 dropped by a lower margin but also finished the week below the $3.00 level.

Market sentiment has changed dramatically in the past two weeks. Since the highs traded on Friday, October 4, the November 2024 contract is down by more than $0.75 per MMBtu, or 25%. Traders seem to be reacting to temperature forecasts calling for light demand into early November against a backdrop of firming domestic production. While volumes remain well below year-ago levels, recent data suggests that producers are indeed ramping up output, with estimates now eclipsing 100 Bcf per day.

It is still too early to put much stock into seasonal temperature forecasts, but a consensus seems to be forming that we are in for yet another mild winter across key population centers in the East and Midwest. End users should be very cautious, however, about placing too much stock in these outlooks, as long-term temperature forecasts are historically inaccurate. Moreover, even if current forecasts are correct, it would still mean a year-over-year increase in winter heating demand compared to the historically warm Winter 2023-24 season. With LNG export demand also set to increase year over year and production possibly lower, the risk of a tighter fundamental balance remains very much at the forefront.