The Energy Buyer's Guide | 10.14.2024

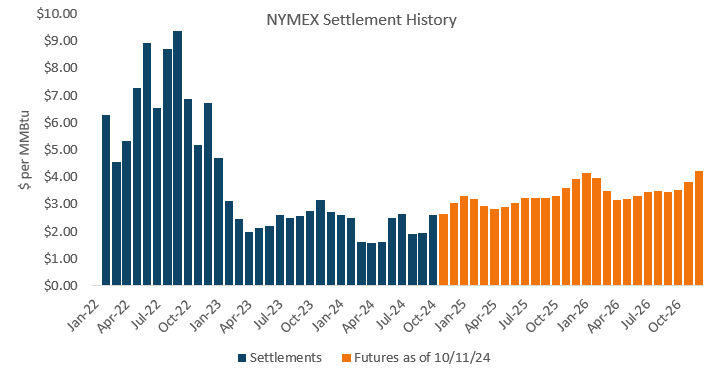

Winter natural gas futures plunge back toward $3.00 per MMBtu.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Natural gas futures fell sharply last week alongside warming weather forecasts for the second half of October, with the Winter 2024-25 strip pushing back toward $3.00 per MMBtu

- The 82-Bcf storage build announced on Thursday was the largest of the fall and came in stronger than market expectations

- Spot natural gas and power prices were up significantly in the West amid lingering air conditioning needs, but mostly quiet elsewhere

- ERCOT and ISO-NE power futures for the balance of 2024 dropped to two-year lows, with ERCOT falling sharply for Calendar 2025 as well

Natural gas futures fell sharply across the board, continuing the bearish momentum from late in the previous week. The prompt-month contract fell to its lowest level since November rolled onto the front of the forward curve. Meanwhile the upcoming Winter 2024-25 strip dipped all the way back to near the bottom of its extended trading range just above $3.00 per MMBtu. Losses were not as pronounced deeper across the curve, with Summer 2025 falling by about $0.10 per MMBtu less than winter and flipping to a premium to that strip.

Last week’s losses were incurred amid forecasts calling for the first significant heating needs of the season. However, as the outlooks evolved, it became apparent that the cold in the Midwest and East would be relatively short lived and give way to a very mild pattern for the second half of the month. The market also reacted to an unexpectedly bearish storage number on Thursday. The 82-Bcf addition to underground inventories was virtually in line with the same week a year prior and came in stronger than consensus market expectations. This implied a potential loosening of the fundamental balance, but more data would be needed to confirm any meaningful shift in underlying market fundamentals.

According to current data, natural gas production remains depressed compared to year-ago levels. Estimates still show output south of 100 Bcf per day compared to about 102 Bcf per day at this same point in 2023. Production last year started to increase in October but showed its most significant growth in November alongside rising heating demand. This illustrated the production industry’s ability to quickly respond to take advantage of more favorable pricing, and the market appears to be banking on a similar pattern emerging in the coming months. Until we see concrete evidence of strengthening supply ahead of the winter heating season, Pinebrook Energy Advisors is maintaining a bullish market outlook for the next 12 months.