The Energy Buyer's Guide | 10.07.2024

Prompt-month natural gas slides lower for the first time in six weeks.

Download the Energy Buyer’s Guide for full commentary and data relating to the U.S. and regional natural gas and power markets:

- Prompt-month natural gas posted its first weekly decline in more than a month after running into strong resistance above $3.00 per MMBtu

- Near-term weather forecasts suggest early heating demand in the Northeast, which led to higher winter natural gas and power forwards across that market

- Natural gas storage inventories added 55 Bcf during the final week of September, continuing to lose ground to historical benchmarks as underlying market fundamentals remain tight relative to recent years

- Domestic natural gas production has been below 100 Bcf per day for five consecutive weeks and is losing ground to year-ago levels, which are now near 102 Bcf per day

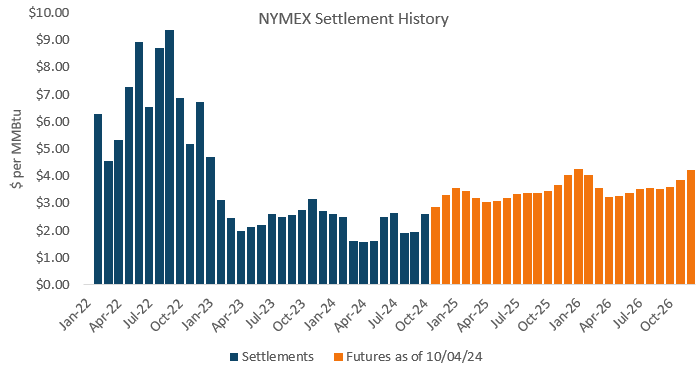

Prompt-month natural gas traded lower last week, breaking a streak of five consecutive weeks higher. The November 2024 contract looked to be on the verge of extending that streak, but the market reversed sharply lower on Friday ahead of the weekend. The front of the curve ran into stout resistance surrounding $3.00 per MMBtu. That psychological benchmark was tested on Wednesday and Friday, with selling pressure coming into the market on both occasions and leading to downside reversals. Friday’s intraday high of $3.019 per MMBtu was the highest for prompt-month gas since June 13, but the market ultimately finished the day more than $0.15 per MMBtu off of that multi-month high. The Winter 2024-25 strip was virtually unchanged on the week, while Summer 2025 edged modestly higher.

Last week’s price action was an indication that the recent rally in natural gas futures may have been overextended. With $3.00 per MMBtu confirmed as important psychological resistance, that level will present the first major hurdle standing in the way of further upside in the coming weeks. Fundamentally, market participants will continue to weigh the shrinking storage surplus against sagging shoulder season demand. With heating load slowly beginning to bubble up, residential and commercial demand will become a more important driver of weekly storage changes. For now, winter NYMEX futures are holding at more than 10% above September lows, as the market awaits more clarity surrounding the direction of domestic production against the major unknown of realized winter weather. It would be reasonable to expect a cooler season than the record warm Winter 2023-24, but winter weather will remain shrouded in uncertainty even as more detailed seasonal forecasts are released in the coming weeks.