NYMEX Model Portfolio Purchase Alert | 10.14.2025

Bolstering coverage across the curve with Winter '25-26 trading near multi-year lows.

We are issuing another purchase in the NYMEX Model Portfolio. Details of the buy are in the main body of the post and in the attached document, but first, some notes:

We started this from scratch in March 2025, so we are not assuming any positions were put on for the upcoming summer or following winter prior to then. We are mimicking a scenario where we take on a new client that has no existing hedge positions but wants to start initiating a forward purchasing program.

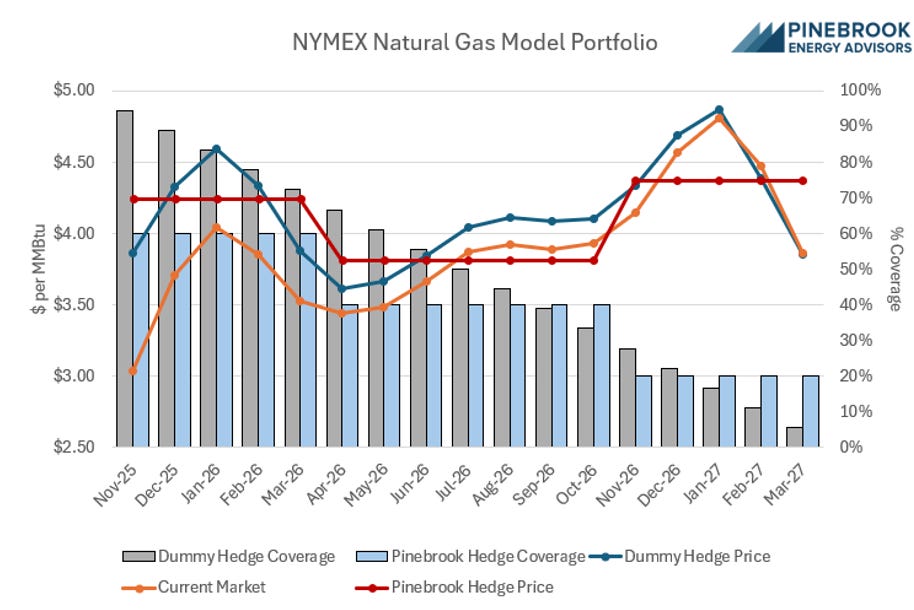

Part of this program includes comparing the Pinebrook position to a benchmark “Dummy Hedge.” We recognize that we kicked this off in a tough market and our initial positions will be at a steep disadvantage to the Dummy Hedge benchmark, which has been building up over the past 18 months. This will correct itself over time.

You’ll find a lot of answers in this post, but feel free to reach out directly if you have additional questions.

The NYMEX Model Portfolio posts are proprietary in nature and available to Market Participant Tier subscribers. If you’d like a free trial, please use the button below:

We are adding 40% to the Model Portfolio position for November 2025 through March 2026. This brings total coverage for these months to 80% at a weighted average price just below $4.25 per MMBtu. Beyond that, we are bolstering our position by 20% for April 2026 through October 2026 to bring coverage for those months to 40% at an average price of $3.81. Finally, we are also adding an initial 20% piece to November 2026 through March 2027 to establish the first layer of coverage for those months at $4.37 per MMBtu.

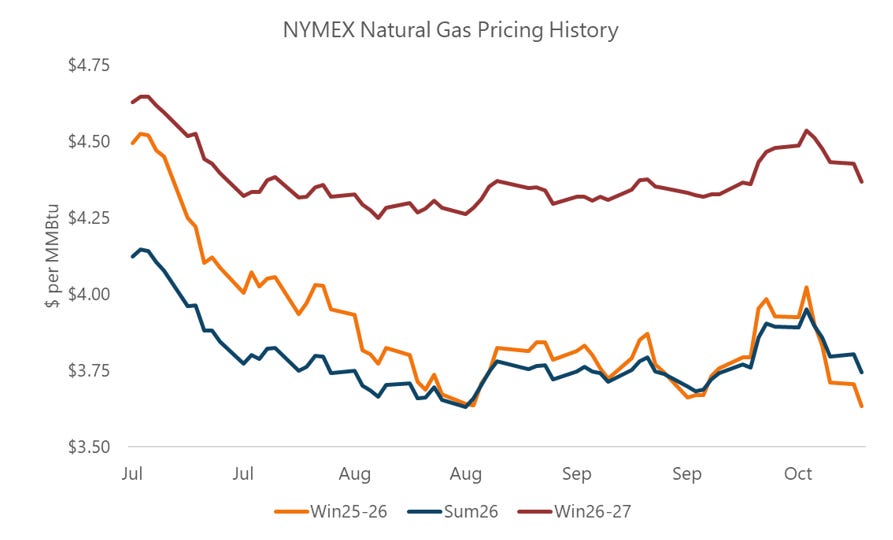

Natural gas futures pricing has declined substantially over the past week, bringing the Winter 2025-26 strip back in line with multiyear lows south of $3.65 per MMBtu – down more than $0.50 per MMBtu from last week’s highs. Forecasts for ongoing mild weather deep into October and healthy storage inventories have helped to weigh on nearby pricing, as the market has largely avoided major risk factors since the beginning of the summer.

Summer 2026 and beyond has experienced weakness as well, although these contracts continue to hold more premium based on long-term structural risks associated with the next wave of LNG export demand.

The previous Model Portfolio Recommendation came on July 1, and we have patiently watched the market in the months since. With nearby winter strip pricing now pushing on its lows, we believe this is an opportunity to greatly increase coverage for these contracts while bolstering the position deeper across the forward curve.

The actions taken by the Model Portfolio are hypothetical in nature and should not be taken as advice or a recommendation to enter into any sort of a financial transaction. The activity is meant to mimic the more specific advice given within an energy management engagement. Think of the model portfolio as a “peek behind the curtain,” scratching the surface of the robust advice that we give to our clients.

Every entity has its own goals and objectives that should be considered in outlining a specific and actionable risk management plan. Pinebrook Energy Advisors assists our clients in developing these plans in order to strike an appropriate balance between remaining open to future opportunities while still safeguarding against market risk and uncertainty.

If you have any questions about your current situation and how to best construct an actionable risk management plan to meet your organization’s specific needs, please reach out to Andy Huenefeld, Managing Partner with Pinebrook Energy Advisors at 502.718.1582 or [email protected].