Natural Gas Storage: +78 Bcf

Storage build outpaces historical benchmarks amid mild weather patterns.

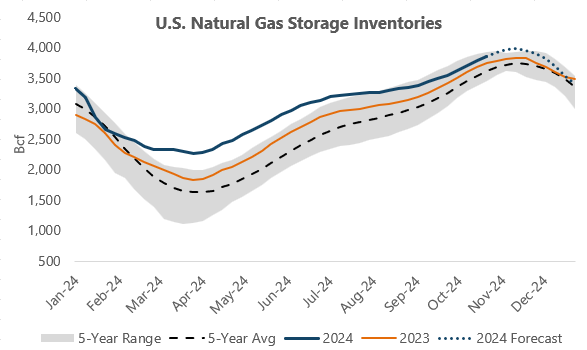

The U.S. Energy Information Administration reported a weekly injection of 78 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending October 25, 2024 (Link). Total inventories now stand at 3,863 Bcf, 107 Bcf (2.8%) above year-ago levels and 178 Bcf (4.8%) above the 2019-2023 average for the same week.

The EIA reported yet another sizable build into natural gas inventories for the week ended October 25, with stocks growing by 78 Bcf. The headline number came in above the five-year average for the second straight week and edged out the build for the same week in 2023 for the first time since August. Market expectations coming into the report called for a build near 82 Bcf, with the range of forecasts spanning from 75 to 95 Bcf. As opposed to the previous week, when the announced injection came in well above consensus forecasts, today’s build was within the range of expectations and slightly lower than the average published outlook. Like the previous week, nearly half of the net build came in the South Central, where 17 and 18 Bcf was added to Salt and Nonsalt storage, respectively. As South-Central builds have remained robust in recent weeks, the rest of the country is seeing net injections trending lower ahead of the winter season.

The lighter-than-expected nature of the build so far has done nothing to deter the return of bearish sentiment into the marketplace. Futures pricing plunged lower ahead of this week’s November 2024 NYMEX contract expiration. December was mostly steady yesterday in its first day trading on the front of the forward curve, but today that contract was already leading the rest of the curve sharply lower prior to the data release, with that trajectory persisting in the wake of the news. The market seems to be focused squarely on overtly bearish temperature forecasts stretching into the second half of November that could extend the injection season or severely limit early-season storage withdrawals.

At the time of writing, the December 2024 NYMEX natural gas futures contract is trading at $2.740 per MMBtu, down $0.105 per MMBtu from yesterday’s settlement.

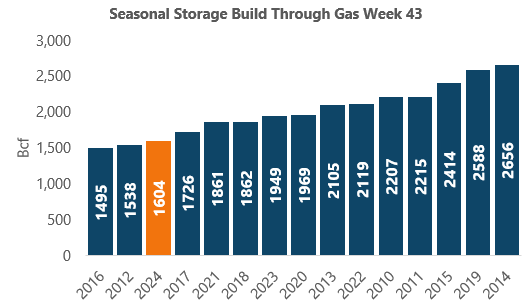

With mild temperatures now expected to extend across key population centers into at least mid-November, inventories could continue to growth through the week ending November 15. Based on this outlook, we now see a possibility that stocks could eclipse 3.95 Tcf and even approach 4.0 Tcf before the onset of net withdrawals.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: