Natural Gas Storage: +76 Bcf

The EIA report showed a build in line with market expectations and light compared to historical benchmarks.

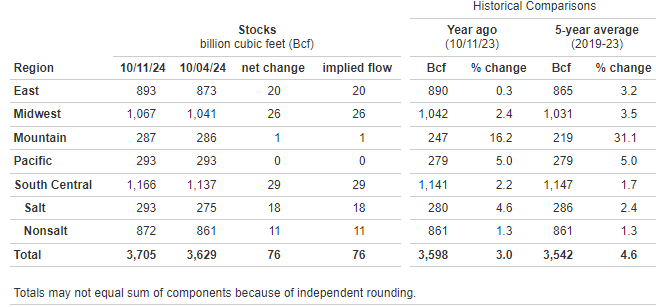

The U.S. Energy Information Administration reported a weekly injection of 76 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending October 11, 2024 (Link). Total inventories now stand at 3,705 Bcf, 107 Bcf (3.0%) above year-ago levels and 163 Bcf (4.6%) above the 2019-2023 average for the same week.

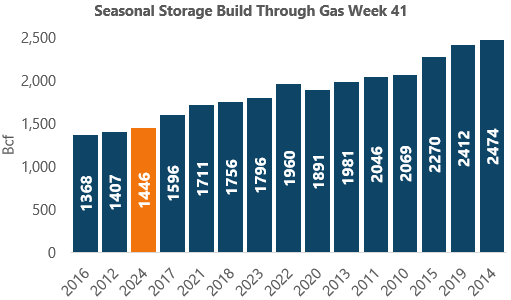

Today’s storage report saw 76 Bcf of natural gas added to working inventories during the week ended October 11. This marked the seventh straight report showing a build that was lower than both last year and the five-year average. Stocks have increased at a relatively slow pace all summer, with total inventory growth of 1,446 Bcf since April compared to 1,761 Bcf during the same period in 2023 and a five-year average of 1,916. Strong structural demand and export needs combined with sagging domestic production have accounted for the lighter injection season in 2024, but stocks are still holding onto a thin surplus to historical benchmarks entering the final weeks of summer.

Today’s injection came in about as expected by the market. Published surveys showed average forecasts near 75 Bcf and ranging from the low 60s to low 80s. The build was 6 Bcf smaller than the previous report, suggesting that the fundamental balance tightened by nearly 1 Bcf per day week over week.

Price action in the futures market has been especially bearish over the past two weeks. The prompt-month November contract traded briefly above $3.00 per MMBtu on October 4 before plunging to as low as $2.345 per MMBtu this morning. The market initially firmed in a knee-jerk reaction following the storage report, but prices have reverted to about flat on the day in the wake of the news. At the time of writing, the November 2024 NYMEX futures contract is trading at $2.370 per MMBtu, up by less than a penny on the day.

The South Central saw the strongest weekly storage injection, adding a total of 29 Bcf between Salt and Nonsalt inventories. That region had been subject to drawdowns during most of the last two months, but cooling weather in Texas is now allowing stocks to build at a stronger rate leading into the winter. Heating needs became a bit more prevalent in the East and Midwest last week, limiting storage injections in those regions. Mountain stocks added 1 Bcf to already record levels, with some facilities in that region almost certainly nearing containment. The Pacific, meanwhile, saw storage levels unchanged for the second straight week.

Depending on temperature patterns for the balance of October and early November, we are likely to see between 3 and 5 more net storage injections prior to the onset of regular withdrawals. If injections are extended into November, those volumes are typically relatively small. We still anticipate storage levels to reach a peak near 3.85 Tcf heading into the winter.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: