Natural Gas Storage: +58 Bcf

Injection comes in stronger than expected, but still behind historical benchmarks

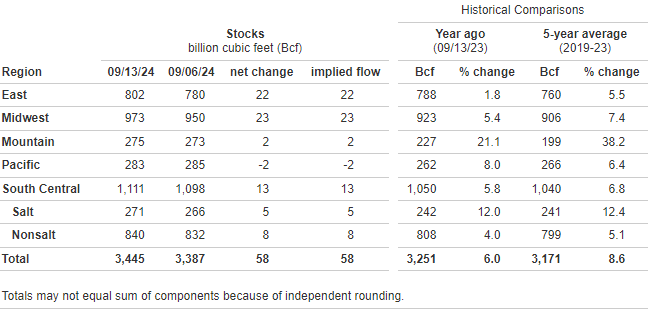

The U.S. Energy Information Administration reported a weekly injection of 58 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending September 13, 2024 (Link). Total inventories now stand at 3,445 Bcf, 194 Bcf (6.0%) above year-ago levels and 274 Bcf (8.6%) above the 2019-2023 average for the same week.

The EIA reported a 58-Bcf injection into underground inventories in this morning’s report. This was the largest weekly addition to natural gas storage since the first week of July and is indicative of seasonal declines in cooling needs. However, the build still fell shy of the five-year average and year-ago injections, which came in at 80 and 62 Bcf, respectively. The surplus to each of those benchmarks continues to contract, with stocks growing at a pace of more than 2 Bcf per day slower than the five-year average and about 1.5 Bcf per day behind 2023 up to this point in the season. In contrast with recent weeks, today’s announced number was larger than consensus market expectations, which centered around a build of 54 Bcf.

After two straight overtly bullish storage numbers, today’s data represents a bit of a mixed bag. The market’s initial knee jerk reaction was to the downside as the build did come in higher than most market forecasts. However, prices very quickly stabilized and ended up pushing higher than where the market was trading prior to the report as the data was digested. This data still suggests a tight underlying fundamental balance, which is helping to keep a floor under market pricing through the upcoming winter. In the 45 minutes since the storage report was released, the prompt-month October contract has bounced off the daily lows just above $2.22 per MMBtu and is now trading near $2.27, down only modestly from yesterday’s close.

Salt inventories in the South Central recorded their first weekly build since June, perhaps indicating softer demand in the region. The Pacific was the only area to show a net deduction, while Mountain stocks edged higher from already record territory.

Pinebrook Energy Advisors projects storage inventories to peak near 3.85 Tcf in November before the onset of winter withdrawal season. This number is highly dependent on weather patterns between now and the end of summer, as lingering heat and/or early cold could lead to a lower storage outcome.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: