Natural Gas Storage: +42 Bcf

Natural gas stocks register a larger-than-normal increase amid mild weather.

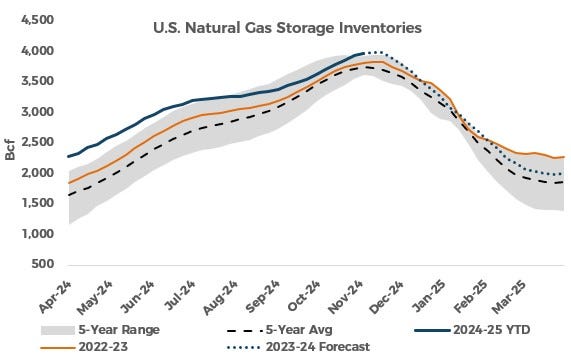

The U.S. Energy Information Administration reported a weekly injection of 42 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending November 8, 2024 (Link). Total inventories now stand at 3,974 Bcf, 158 Bcf (4.1%) above year-ago levels and 228 Bcf (6.1%) above the 2019-2023 average for the same week.

Natural gas storage inventories increased by 42 Bcf during the first full week of November. This technically represents the first week of the natural gas winter season, but it has seen storage additions in 12 of the last 15 years. This week’s report continued the trend of larger-than-normal storage builds, adding to both the year-ago surplus as well as the surplus to the 2019-2023 average. The main driver of the larger-than-normal build was the continuation of mild temperatures across the major gas consuming regions of the Midwest and East during the report week, which helped to limit heating demand. Market expectations heading into today’s report centered around a build of 41 Bcf, with estimates ranging from a build of 26 to 56 Bcf.

NYMEX futures pricing moved lower following the report, giving back some of the gains recorded earlier in the week. While prices were beginning to soften ahead of the report, the build coming in line with expectations helped send futures pricing lower on the day.

At the time of writing, the December 2024 NYMEX natural gas futures contract is trading at $2.854 per MMBtu, down $0.129 per MMBtu from yesterday’s settlement.

Today’s build included another robust addition to South Central inventories, with Salt storage levels jumping by 8 Bcf to reach 349 Bcf, the highest level of 2024. Nonsalt inventories recorded a larger-than-normal 11 Bcf increase, bringing total South Central storage volumes to the top of the 5-year range.

Recent shifts in near-term temperature forecasts, coupled with lower daily natural gas production estimates during the current week, have led us to lower our peak storage forecast slightly. Pinebrook Energy Advisors is now expecting the report for the week ending November 15 to show the final storage build of the season. Further, we anticipate the reported addition will fall below the 26 Bcf required to push total inventories to the 4-Tcf level. While inventories will enter the withdrawal season below that threshold, a level that has only been eclipsed twice before, the natural gas market will enter the winter with sufficient inventories to meet demand.

One note on the EIA methodology used to sample natural gas storage facilities to produce the weekly storage report – beginning with the report for the week ending November 15, the EIA will begin publishing weekly storage data using a new sample of storage operators. Moreover, they will be revising the previous 8 weeks of data to gradually phase in the estimates from the new sample. More information can be found at this Link.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: