Natural Gas Storage: +40 Bcf

EIA reports another smaller-than-expected storage build

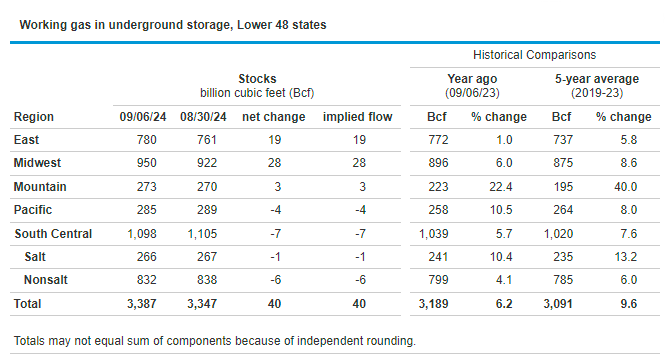

The U.S. Energy Information Administration reported a weekly injection of 40 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending September 6, 2024 (Link). Total inventories now stand at 3,387 Bcf, 198 Bcf (6.2%) above year-ago levels and 296 Bcf (9.6%) above the 2019-2023 average for the same week.

Working gas in underground storage increased by 40 Bcf across the U.S. last week, according to this morning’s government report. The build lagged historical benchmarks while also falling short of consensus market expectations, which centered around a build closer to 46 Bcf. The range of published forecasts for this week’s report was especially wide, indicating a large degree of uncertainty in the marketplace following the previous week’s significant miss. Stocks have been growing at a slow pace so far, with the summer-to-date build of 1,128 the lowest since 2016 at this point in the season. Accordingly, the surpluses to last year and the five-year average continue to shrink, now sitting at the lowest levels since early February.

This was yet another bullish storage report, and so far the market is responding in kind. Futures pricing was flat to lower earlier this morning but reversed to the upside immediately following the data release. The prompt-month contract has been struggling to push above demonstrated resistance surrounding $2.30 per MMBtu, but in the 15 minutes since the EIA report, benchmark pricing is trading above that level at a two-month high. The market attempted a breakout yesterday morning as well, but ultimately finished the day back below resistance, so the price action for the remainder of the day will be interesting to say the least. A daily settlement above $2.30 could usher in a new wave of buying interest, while an intraday reversal back to the downside would solidify the resistance zone.

The South-Central recorded yet another drawdown, with 6 Bcf coming out of Nonsalt storage and a 1-Bcf reduction from Salt. Pacific inventories also showed a net decline amid a major heat wave across the West. Stocks increased incrementally in the Mountain Region, while the East and Midwest both saw more significant builds.

Storage builds are expected to generally trend higher over the next month before heating needs begin to increase demand in late October. We continue to forecast end-of-summer inventories to peak between 3.85 and 3.90 Tcf, but recent weekly data suggests that the risk to that outlook may be to the downside.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: