Natural Gas Storage: +35 Bcf

Stocks rise by 35 Bcf for the second straight week, falling short of consensus forecasts.

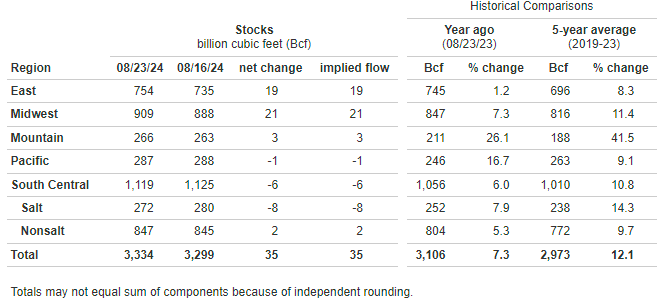

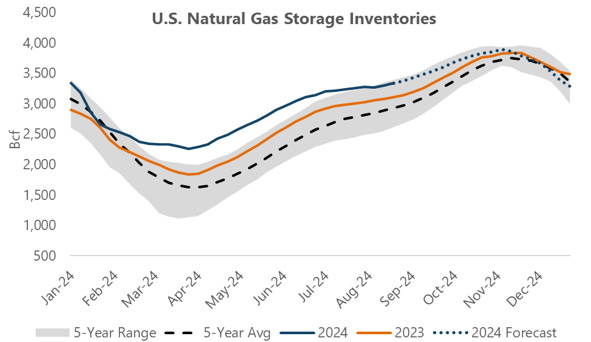

The U.S. Energy Information Administration reported a weekly injection of 35 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending August 23, 2024 (Link). Total inventories now stand at 3,334 Bcf, 228 Bcf (7.3%) above year-ago levels and 361 Bcf (12.1%) above the 2019-2023 average for the same week.

For the second consecutive week, U.S. natural gas working inventories increased by 35 Bcf. This is also the second straight week that the storage build came in stronger than the same week in 2023 but lighter than the five-year average. In contrast with the previous report, however, the latest number came in on the bullish side of market forecasts, falling shy of consensus expectations calling for a build of 39 Bcf. The data implies that the fundamental balance was unchanged week over week, which tracks estimates that showed supply and demand numbers moving in parallel compared to the previous report week.

Today is the first day on the front of the forward curve for the October 2024 NYMEX contract, which rolled onto the prompt at a premium of about 17 cents to yesterday’s September expiration of $1.930 per MMBtu. The market reaction to this morning’s data was mostly muted, as benchmark futures pricing was already off of the daily lows prior to the EIA’s 10:30am release. In the half hour following the storage report, the front of the curve is down modestly on the day near $2.08 per MMBtu, with slightly more pronounced declines for deliveries further into the future. Overall, this still has the look of a rangebound market that is largely looking past the balance of summer and focusing on the fall shoulder period and subsequent winter heating season.

This week’s report showed ongoing drawdowns in Salt storage levels in the South Central and a slight pull in Pacific stocks. The East and Midwest registered robust builds, while the Mountain Region recorded a slight increase on top of already-record inventory levels for that area.

Going forward, we are likely to see 10 more weekly storage builds before the onset of net withdrawals. The report covering the current week will likely show a much smaller storage build due to higher demand amid what looks to be the last major heat wave of the summer. From there, weekly builds should trend higher before heating load begins to play a bigger part of the equation in October. Based on our current assumptions for supply and demand for the remainder of the injection season, we expect inventories to top out just below 3.9 Tcf, which would place inventories ahead of the winter marginally above year-ago stocks and at a surplus of about 150 Bcf to the five-year average.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: