Natural Gas Storage: -3 Bcf

Natural gas stocks post a small net decline during the second week of November.

The U.S. Energy Information Administration reported a weekly withdrawal of 3 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending November 15, 2024 (Link). Total inventories now stand at 3,969 Bcf, 141 Bcf (3.7%) above year-ago levels and 239 Bcf (6.4%) above the 2019-2023 average for the same week.

Natural gas storage inventories posted the first net withdrawal of the season, coming during a week during which most market participants were expecting a small net injection. The 3-Bcf deduction in working gas stocks contrasts with a 12-Bcf build reported during the same week in 2023 but was lighter than the 16-Bcf withdrawal in the five-year average. Most published forecasts heading into today’s report called for a single-digit build, with some outliers projecting a draw of as much as 7 Bcf. The actual number implies that the fundamental balance tightened by more than 6 Bcf per day compared to the previous week. This is due mostly to increased space heating demand from the residential and commercial sectors, with the tighter balance exacerbated by sagging production volumes during the report week.

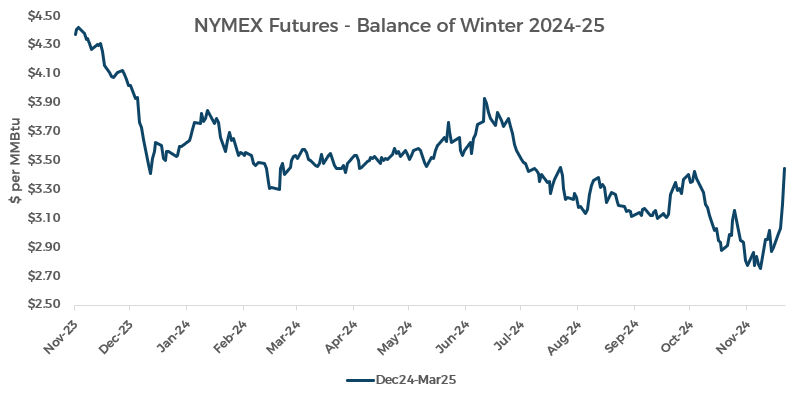

Forward NYMEX pricing is rallying sharply this week, with the prompt-month December 2024 contract surging past psychological resistance surrounding $3.00 per MMBtu and accelerating to the upside. The rally is being driven by forecasts for widespread cooler-than-normal temperatures on the horizon, promising a quick ramp up in heating needs for late November and early December. With bullish sentiment already in control prior to this morning’s report, the surprise nature of the announced withdrawal seemed to help justify the morning price action and helped push the market to fresh highs in the wake of the news.

At the time of writing, the December 2024 NYMEX natural gas futures contract is trading at $3.433 per MMBtu, up $0.240 per MMBtu from yesterday’s settlement.

A 12-Bcf withdrawal in the East was the primary driver in the overall net deduction in U.S. stocks. The Midwest also showed a decline, but stocks in that region fell by just 1 Bcf. Other areas registered small net injections, including the Mountain Region, which edged further into unprecedented territory going into the winter.

With today’s storage report in the books, we can safely assume the seasonal peak of 3,972 Bcf was established as of November 8. This represents the third highest U.S. storage level on record and the highest since stocks last eclipsed 4 Tcf in 2016. However, all focus now shifts to the withdrawal season, which is expected to ramp up considerably in the coming weeks. Based on current seasonal weather outlooks and Pinebrook’s projections for supply and demand over the coming months, we expect inventories to find a seasonal bottom between 1.9 and 2.0 Tcf in March. This would represent a slim surplus to the five-year average but a deficit to year-ago stocks.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: