Natural Gas Storage: -190 Bcf

Weekly draw came in much stronger than market expectations and historical benchmarks.

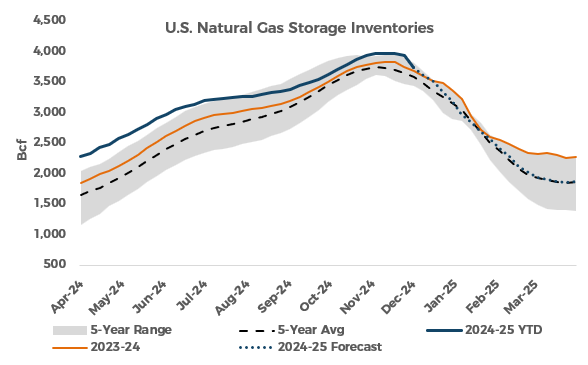

The U.S. Energy Information Administration reported a weekly withdrawal of 190 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending December 6, 2024 (Link). Total inventories now stand at 3,747 Bcf, 67 Bcf (1.8%) above year-ago levels and 165 Bcf (4.6%) above the 2019-2023 average for the same week.

Natural gas inventories declined rapidly during the week ended December 6 as heating needs ramped up across key population centers. The 190-Bcf deduction reported by the EIA represents the largest ever storage draw recorded this early in the winter season. There have been a handful of larger draws recorded in December, but they have all come later in the month. Today’s announced number was bullish compared to both last year and the five-year average, which show draws of 72 and 71 Bcf, respectively. Inventories are now just 67 Bcf ahead of year-ago levels, which is the slimmest surplus since January, while the surplus to the five-year average was reduced to 165 Bcf, bringing that cushion back to nearly in line with levels last seen in early October.

Market expectations heading into today’s report fell in a wide range, spanning from a draw of 144 Bcf to 212 Bcf, with most estimates centered around a 165-170-Bcf withdrawal. This puts the actual number on the bullish end of the range and well above the consensus market forecast.

Natural gas futures pricing has rallied so far this week, with the prompt-month contract pushing back near the November highs based on cooling near-term temperature outlooks. Prices were relatively flat this morning heading into the release of the government storage report and has continued to firm in the wake of the news. In the hour following the report, the front of the curve is pushing on new weekly highs.

At the time of publication, the January 2025 NYMEX natural gas futures contract was trading at $3.463 per MMBtu, up $0.085 per MMBtu from yesterday’s settlement.

The South Central saw an especially robust draw compared to the net builds recorded through November, with Salt storage declining by 22 Bcf and Nonsalt storage in that region dropping by 37 Bcf. East and Midwest stocks declined by 58 and 60 Bcf, respectively, bringing both regions to a slim deficit to year-ago levels. Mountain and Pacific stocks registered smaller deductions as those areas largely avoided the cold weather during the report week.

Next week’s report will be interesting in that it will include a short stretch of mild weather sandwiched between periods of cold. From there, current outlooks point toward another cold snap potentially developing in the populous East late in the two-week period. Inventories are likely to fall to a deficit to year-ago levels before the end of the month. Pinebrook Energy Advisors now projects inventories to bottom near 1.9 Tcf in the spring prior to next year’s injection season.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: