Natural Gas Storage: +13 Bcf

Heavy cooling load leads to smaller-than-expected storage build.

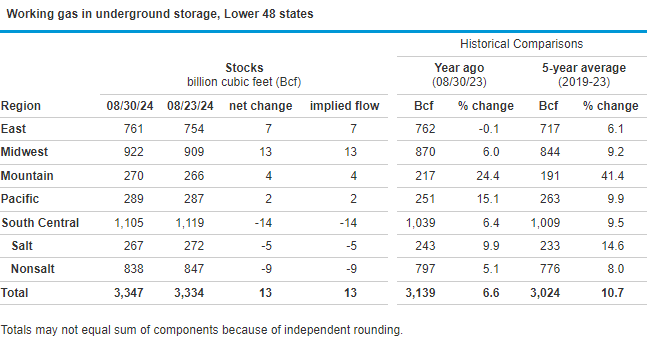

The U.S. Energy Information Administration reported a weekly injection of 13 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending August 30, 2024 (Link). Total inventories now stand at 3,347 Bcf, 208 Bcf (6.6%) above year-ago levels and 323 Bcf (10.7%) above the 2019-2023 average for the same week.

Storage inventories grew by only 13 Bcf during the final week of August amid what looks to be the last major heat wave of the summer. Market estimates heading into the report were calling for a build ranging from 19 to 33 Bcf, meaning the actual number came in tighter than even the most bullish of the published forecasts. Heavy early-week cooling needs pushed power generation demand to estimated levels north of 50 Bcf per day, but the light storage injection could mean that actual demand was even higher than initially thought. The surplus to the five-year average continued to narrow, as the injection lagged that benchmark for the eighth straight week. Additionally, following two consecutive weeks of stronger storage builds than the same period in 2023, this week’s injection fell shy of the 33-Bcf increase reported a year prior. The current surpluses to last year and the five-year average are at the lowest since the week ended February 2.

This storage data is bullish by any objective measure, with the weekly build lagging historical benchmarks and market expectations by a considerable clip. The market responded accordingly, with the prompt-month NYMEX contract jumping higher immediately following the EIA release and continuing to push to new highs as traders digest the data. At the time of writing, the October 2024 NYMEX futures contract is trading up about 12 cents on the day at $2.27 per MMBtu, which is near the top of the recent range and just below demonstrated technical resistance surrounding $2.30 per MMBtu.

The South-Central Region saw a 14-Bcf drawdown, which was likely the biggest contributing factor to the deviation between the actual net build and market forecasts. Stocks in that region have been on the decline since late June, which is not atypical due to heavy reliance on natural gas for power generation needs in that part of the country. Stocks increased during the report week in every other area, pushing further into all-time record territory in the Mountain Region.

Storage builds should trend higher in the coming weeks due to falling cooling needs across key population centers. While today’s report showed considerable fundamental tightness in late August, it does not do much to alter the overall trajectory of inventories. With 10 weeks left in the season, we still see storage levels on track to reach a peak just below 3.9 Tcf heading into the winter.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: