Natural Gas Storage: -125 Bcf

Inventories post second straight outsized draw compared to historical benchmarks.

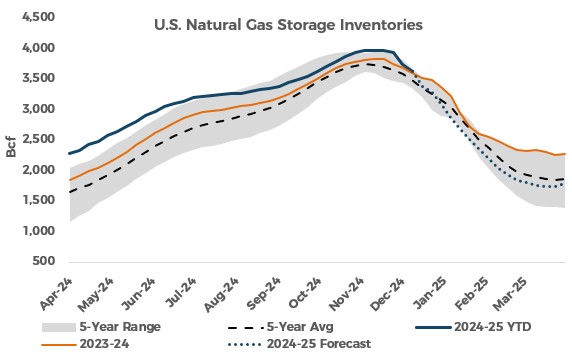

The U.S. Energy Information Administration reported a weekly withdrawal of 125 Billion Cubic Feet (Bcf) in Lower 48 natural gas storage inventories for the week ending December 13, 2024 (Link). Total inventories now stand at 3,622 Bcf, 20 Bcf (0.6%) above year-ago levels and 132 Bcf (3.8%) above the 2019-2023 average for the same week.

Natural gas stockpiles posted the second consecutive draw that came in bullish in comparison to the year-ago and five-year average benchmarks. The 125-Bcf deduction reported by the EIA was lighter than the 190-Bcf pull reported for the week prior, illustrative of lighter space heating demand. This implies that the fundamental balance loosened by more than 9 Bcf per day, week over week. However, the draw came in stronger than historical norms, eclipsing the five-year average withdrawal of 92 Bcf and the 78-Bcf deduction recorded for the same week a year ago. This brings storage levels back to virtually in line with year-ago levels, with stocks poised to fall south of that benchmark before the end of 2024.

Market forecasts coming into this morning’s report spanned from a draw of 117 Bcf to 147 Bcf. Most projections fell near 130 Bcf, placing the actual number into slightly bearish territory in comparison. However, prices have been on the upswing since reversing higher on Tuesday afternoon based on expectations for a potential return of cold weather in early January. Strength persisted through trading yesterday and continued this morning. In the hour since the storage report, the prompt-month contract has pushed to new weekly highs and looks poised to test resistance surrounding $3.55 per MMBtu.

At the time of writing, the January 2025 NYMEX natural gas futures contract is trading at $3.538 per MMBtu, up $0.164 per MMBtu from yesterday’s settlement.

Inventories in the East declined by 34 Bcf, falling to a deficit to both last year and the five-year average. Midwest stocks dropped by 48 Bcf and now sit behind year-ago levels and virtually in line with the five-year average for the same week. The South Central posted the second substantial withdrawal of the season, with 27 Bcf out of the total 29 Bcf draw coming from Nonsalt storage. Mountain and Pacific stocks declined at a more measured rate, and both regions sit at a healthy surplus to historical levels.

The market is anticipating another short cold snap in the coming days followed by a subsequent warm up. From there, predictive models are pointing at a potential for another period of unseasonable cold in the populous Midwest and East. Volatility in weather forecasts is making it especially difficult to project weekly storage changes, but the pattern to date could be setting the stage for a stronger withdrawal season than initially anticipated. Pinebrook Energy Advisors now projects storage levels to bottom near 1.8 Tcf prior to the onset of next year’s injection season.

Detailed Data with Updated Charts in the Natural Gas Storage Report PDF Below: