Natural Gas Market Note | 12.30.2025

NYMEX natural gas futures ended slightly lower after a fairly quiet day of trading.

Natural gas futures ended slightly lower today, the first day with the February 2026 contract in the prompt-month position. Early trading saw February futures rally to the highest level in more than 2 weeks, topping out at $4.176 per MMBtu shortly after 9:00am Eastern. Prices moved lower in an orderly fashion through the rest of the session to end the day close to yesterday’s close at $3.972.

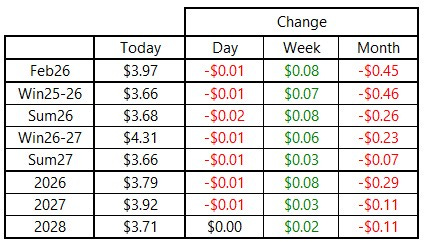

Natural gas futures were little changed out the curve as well, with Calendar Years 2027 - 2030 also ending the day only slightly changed from the previous day’s trading. The market is looking ahead to tomorrow’s Weekly Natural Gas Storage Report - the second this week - which will show the storage change for the week ending December 26, 2025. Tomorrow’s report is expected to show a large departure from the previous three reports, which showed average weekly withdrawals from storage of 170 Billion Cubic Feet (Bcf) and also landed within 11 Bcf of each other (-166 to -177). For the week ending December 26, however, mild temperatures blanketed the U.S. and market participants expect a much lower pull from inventories. The Wall Street Journal’s survey shows an expected withdrawal of only 46 Bcf from underground inventories, with estimates ranging from a draw of 38 Bcf to a drop of 56 Bcf.

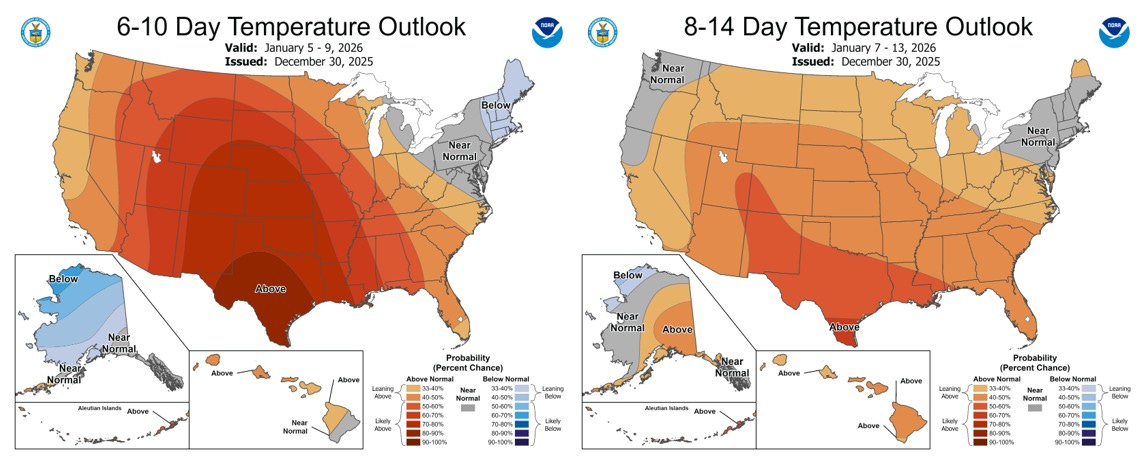

Looking ahead, following a brief cold snap to begin the new year, temperatures are expected to moderate for the first half of January with the warmest anomalies centered over Texas and the Southern half of the country.

An archive of Daily Natural Gas Market Notes can be found here.