Natural Gas Market Note | 12.29.2025

Prices continue higher into January 2026 NYMEX expiration.

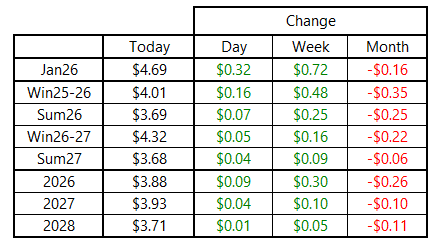

The recent rebound in natural gas futures pricing continued on Monday, with the January 2026 contract rallying sharply on its final day of trading before expiring at $4.687 per MMBtu. The contract experienced a volatile ride during its time as the prompt month, trading as high as $5.496 per MMBtu on December 5 and as low as $3.797 on December 22. The expiration price landed almost exactly at the midpoint of that range, as the market reconciled weather-related risks for the month ahead. This marked the highest NYMEX expiration in exactly three years, falling just short of the January 2023 contract, which rolled off the board at $4.709 per MMBtu.

Today’s price action was heavily concentrated at the front of the forward curve, as short positions appeared to be forced to cover ahead of expiration. Gains from February 2026 and beyond were much more muted. February 2026, which will move to the prompt-month position tomorrow, finished the day at $3.986 per MMBtu, just below key psychological resistance at $4.00.

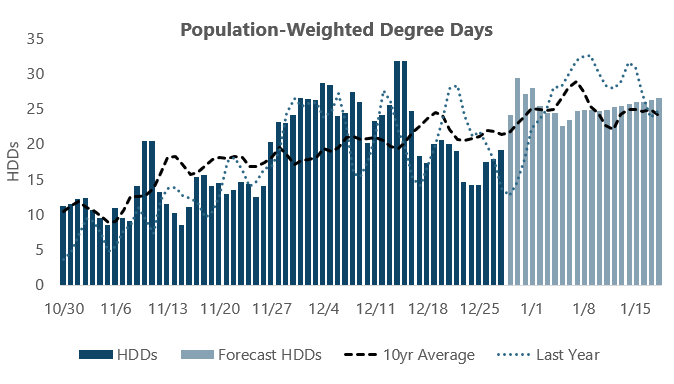

Temperature patterns flipped dramatically overnight across the middle of the country, with frigid weather expected to push east in the coming days. The 1–5 day outlook shows much cooler-than-normal temperatures across the eastern half of the U.S., with anomalies expected to moderate beyond that window. In contrast to forecasts as recently as a week ago—which showed no days with elevated heating degree days (HDDs)—the current outlook keeps HDDs near or above normal for the majority of the two-week period.

An archive of Daily Natural Gas Market Notes can be found here.