Natural Gas Market Note | 12.23.2025

Prices surge back to the upside as cold weather shows back up in the forecast.

***Daily Market Notes will not be published for the remainder of the week and will resume on Monday, December 29***

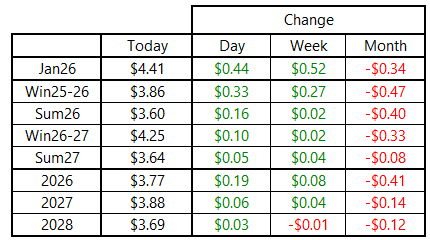

Anyone who thought winter was over in mid-December will be sorely disappointed when they look at the newest weather maps. On the heels of a dramatic decline ahead of this week’s historic warmth, natural gas futures rallied sharply on Tuesday, gaining back a large portion of the recent losses. Gains were most prominent on the front of the forward curve, where the January 2026 contract added 44 cents to settle north of $4.40 per MMBtu. Beyond the balance of winter, contracts were still up on the day, but not near as significantly.

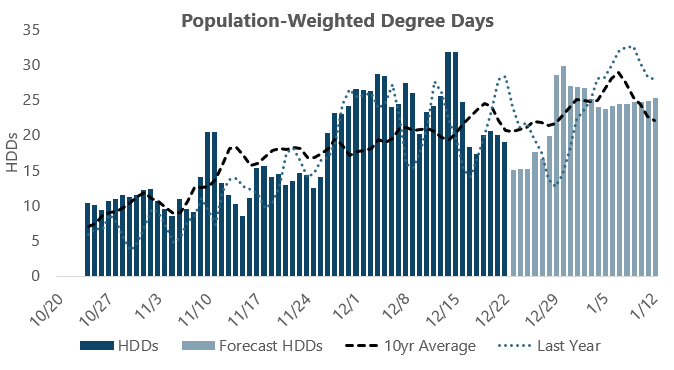

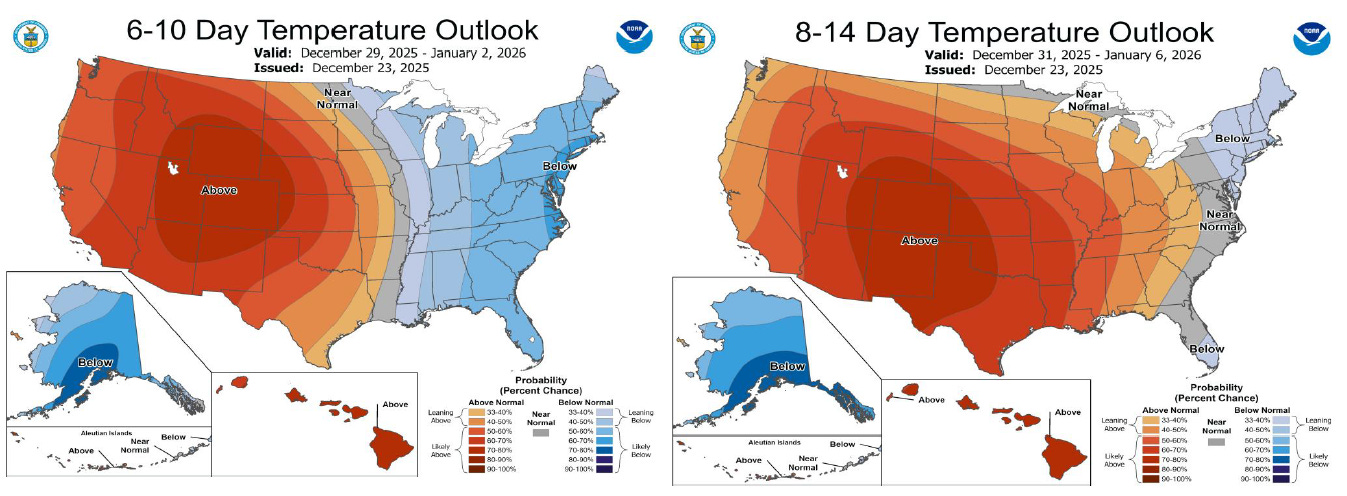

Temperature models shifted to the cold side beyond the next 5 days, with the period from December 29 through January 2 seeing the most significant impact. The cold is not expected to be as intense as what was realized at times earlier in the month, but the change from the previously-expected widespread warmth to a colder-than-normal pattern was jarring for the market. Compared to yesterday, that five-day stretch added 24 population-weighted heating degree days.

The timing of the cold shift also likely played into the severity of the price increase. With thinner volume expected for the remainder of the week surrounding the Christmas holiday, traders holding profitable short positions were likely compelled to cover and not risk going into the holiday period exposed to the potential for further progression to the upcoming cold in upcoming model runs. The NYMEX market is open on December 24 and 26, but trading activity on these days will likely be lighter than usual.

An archive of Daily Natural Gas Market Notes can be found here.