Natural Gas Market Note | 12.22.2025

January ends a volatile day nearly unchanged after back-and-forth swings.

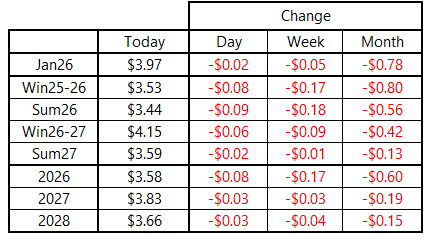

Natural gas futures traded in a wide range to kick off the holiday-shortened week, with January 2026 hitting an overnight high of $4.140 and an intraday low of $3.797 per MMBtu. That contract settled near the middle of the range near $3.97 per MMBtu, down just under 2 cents on the day. Losses were deeper further out the curve, but contracts across the board ended the day well off of daily lows as well as overnight highs.

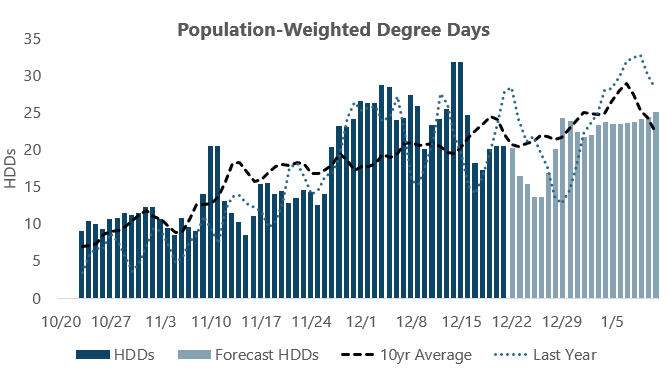

At open on Sunday evening, it looked like the market was poised to post gains today, but upward momentum could not be sustained with the prompt-month contract above $4.00 per MMBtu. While warm anomalies are poised to soften beyond the next five days, there is still no indication that a major pattern shift is on the way. Until the market sees signs of a return of arctic air to key population centers, the path of least resistance will likely remain to the downside, even as the market seems to have a bit more support beneath it than during the major selloff two weeks ago.

With no government storage report on the docket this week, the market will have to wait until after the Christmas holiday for data covering the week ended December 19. Early expectations for that report point to a slightly larger draw than the 167-Bcf pull for the previous week. From there, however, we should see a series of relatively small withdrawals, especially for the current week.

An archive of Daily Natural Gas Market Notes can be found here.