Natural Gas Market Note | 12.18.2025

Futures finish lower as upside momentum runs dry.

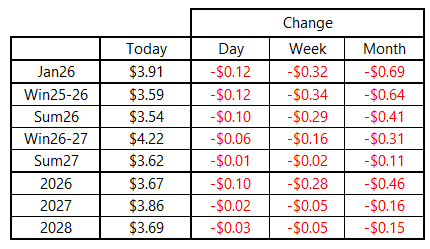

Natural gas prices looked this morning like they were on the verge of the second straight day of gains. However, an “as-expected” storage report and another round of warm model runs helped turn the front of the curve back below $4.00 per MMBtu and return pricing to Wednesday’s lows. The January 2026 contract was as high as $4.218 per MMBtu in early morning trading, but upward momentum faded and prices drifted lower for most of the day. January settled near $3.91 per MMBtu after trading in a daily range of nearly 35 cents.

Today’s storage report covering the week ended December 5 showed a 167-Bcf draw. The data reflected lingering cold during the report week and narrowed the surplus to the five-year average to just 32 Bcf. This marks the slimmest cushion to that benchmark since April. Under most circumstances, this would be a bullish data point for the market. However, with a warmup already underway and the two-week outlook showing little in the way of supportive weather, the market largely shrugged off the storage data and continued to slide from the morning highs.

Next week’s report will be released a day early on Wednesday, December 24 due to Christmas falling on Thursday. This is the report that will include the impacts of last weekend’s cold snap that sent estimated residential and commercial demand soaring above 65 Bcf per day. While that report could show inventories falling below the five-year average, the market seems confident that inventories will rebuild the cushion in subsequent reports.

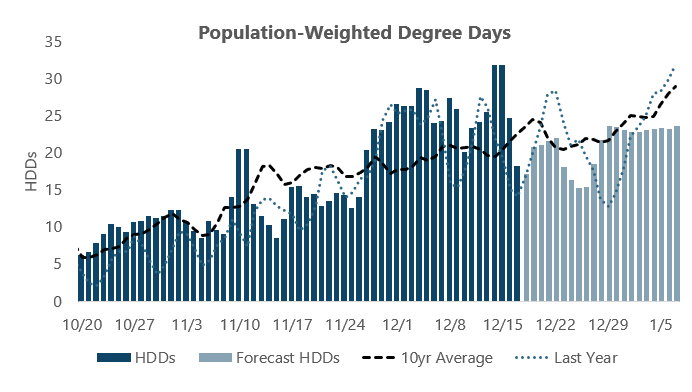

The current near-term forecast shows no major cold events on the horizon, with population-weighted heating degree days expected to remain well below levels observed during the first half of December.

An archive of Daily Natural Gas Market Notes can be found here.