Natural Gas Market Note | 12.17.2025

Prices turn a corner back to the upside, snapping the recent losing streak.

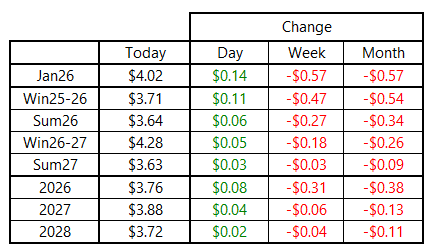

After falling sharply in six of the past seven sessions, benchmark natural gas futures posted their first meaningful daily increase since December 5. The January 2026 contract traded as low as $3.84 per MMBtu yesterday but reversed course and settled back above the $4.00 level on Wednesday. The market appeared due for a bounce, and the lack of downside follow-through after yesterday’s breach of psychological support was likely viewed as a buying signal, prompting profitable shorts to cover and enticing new longs into the market. Gains were less pronounced further out the curve, with Summer 2026 advancing just $0.06 per MMBtu on the day.

After settling at $4.024 at 2:30pm Eastern, upward momentum continued in after-hours trading, with the January contract ticking as high as $4.110 per MMBtu prior to this posting.

There were no dramatic changes to weather forecasts compared to yesterday. Following a stretch of much warmer-than-normal temperatures across most of the U.S., anomalies are still seen easing a bit late in the month. Also, with unseasonable cold expected to linger over New York and New England for much of the two-week period, it should help keep demand propped up to some extent even as the rest of the country is expected to be mild.

Tomorrow’s storage report is expected to show a draw near 169 Bcf, according to a Wall Street Journal survey of analysts. Responses spanned from draws of 155 to 179 Bcf, which is a relatively tight range for the winter. If the consensus is correct, it will further erode the surplus to the five-year average, while widening the deficit to year-ago levels. Beyond today’s report, next week is also expected to show an outsized draw, but subsequent data will reflect reduced demand and allow stocks to rebuild a cushion to the five-year average before the New Year.

An archive of Daily Natural Gas Market Notes can be found here.