Natural Gas Market Note | 12.16.2025

Futures extend losing streak, as January falls below $4.00.

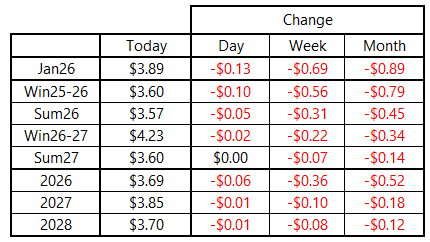

Natural gas futures continued lower on Tuesday, marking the sixth down day out of the past seven for prompt-month gas. Notably, the January 2026 contract pushed below the psychologically important $4.00-per-MMBtu level and held there through the daily settlement. This suggests the market has yet to fall far enough to attract meaningful buying interest, particularly in the absence of any indication that colder weather is on the way. While balance-of-winter contracts lost about 10 cents on the day, the Summer 2026 strip was down only about $0.05 per MMBtu, with losses becoming more muted further out the curve.

The January–March 2026 strip ended the day near $3.60 per MMBtu, marking the lowest daily close for that group of contracts since early 2022 and sitting more than $1.30 per MMBtu below the December 5 highs.

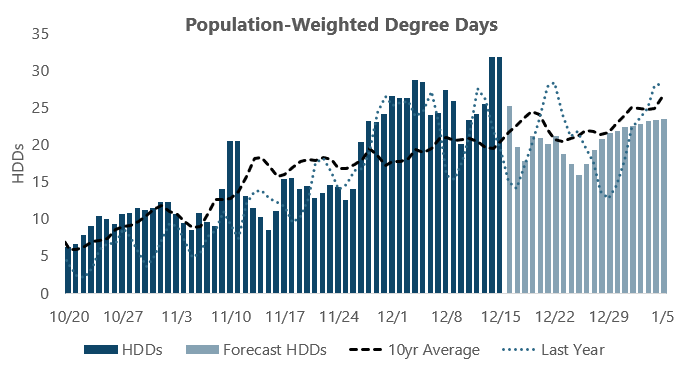

Absent a clear catalyst to turn the tide, momentum remains firmly bearish, especially with the prompt-month contract breaching $4.00 support. Near-term forecasts were little changed from yesterday, with the outlook still pointing to a two-week period of widespread warmth across all regions except the Northeast. Beyond today, there are no days in the forecast through the end of the month showing population-weighted heating degree days coming in materially above normal.

The fallout from the recent extreme cold will show up over the next two storage reports. Early indications for Thursday’s EIA report, covering the week ended December 12, point to a draw in the 160–180 Bcf range. This would further erode the surplus to the five-year average, which posted a 96-Bcf draw, and widen the deficit to year-ago levels, which declined by 134 Bcf during the corresponding week.

An archive of Daily Natural Gas Market Notes can be found here.