Natural Gas Market Note | 12.15.2025

Prices continue to slide, but January finds support near $4.00 per MMBtu.

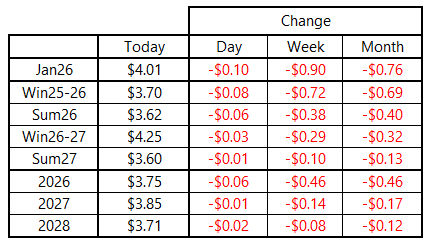

Natural gas prices continued to fall on Monday. The January 2026 contract has now posted losses in five of the past six trading days since testing $5.50 per MMBtu on December 5. Losses were less pronounced beyond the front of the curve, though weakness was still felt in deliveries through 2029. The prompt-month contract dipped briefly below $4.00 per MMBtu for the first time since October 30, but that level is so far holding as psychological support.

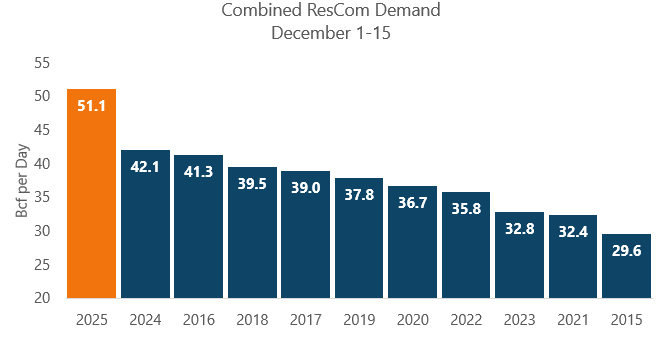

From a population-weighted degree-day standpoint, today is the coldest day of the winter so far. Estimated residential and commercial demand for December 15 exceeded 65 Bcf. This marks the earliest point in the season that combined demand from those sectors has reached this level in at least 10 years. Demand through the first half of December has averaged more than 51 Bcf per day, according to current estimates—by far the highest reading for this same stretch dating back to at least 2015.

However, the second half of the month is poised to look much different. Although weather models trended slightly cooler over the weekend, there is still nothing in the near-term outlook that indicates a flip back to a colder-than-normal pattern. Any extension of the upcoming warm regime will continue to offset the storage impact of the historically cold start to winter. Until the market sees evidence of a return of Arctic air, it may be difficult for futures pricing to get off the mat.

An archive of Daily Natural Gas Market Notes can be found here.