Natural Gas Market Note | 12.12.2025

The rout continues for nearby natural gas ahead of weekend cold.

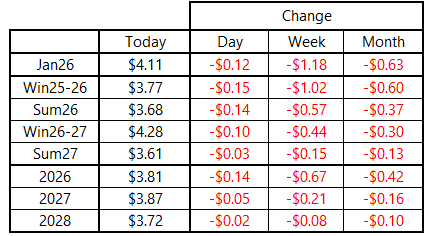

Natural gas futures continued their path sharply lower today, although the magnitude of losses was not as significant as what was observed earlier in the week. The prompt-month January 2026 contract finished the day down about 12 cents, just above $4.11 per MMBtu. That contract, along with the balance-of-winter strip, are down more than $1 on the week, as the market staged a dramatic turnaround from the extreme bullish sentiment observed a week ago. Losses have been less prominent further into the future, but the entire forward curve is now down from both week-ago and month-ago levels.

This weekend through early next week is expected to feature the coldest weather so far this season across key Midwest and East Coast population centers. We should see a spike in residential and commercial demand that is likely to exceed levels recorded during the most recent cold snap.

From there, however, temperature patterns are poised to flip to a widespread warmer-than-normal regime. For now, it is unclear how long this new pattern will stick around, but there has been nothing so far this week in the model runs that suggests an abrupt move back to a broad cold pattern.

When the market opens for trading next week, it will have the benefit of weekend model runs, which will inform the initial direction of price action. If the signals point to further downside, the prompt-month January contract may run into support surrounding the psychologically important $4.00-per-MMBtu level. If that is breached, it may open the floodgates for further declines. However, if models begin to show any hint of a return to cold, the market could reverse back to the upside sharply and quickly.

In any case, we expect volatile winter price action to continue until further notice.

An archive of Daily Natural Gas Market Notes can be found here.