Natural Gas Market Note | 12.09.2025

Prices continue to plunge as end of cold looks to be in sight.

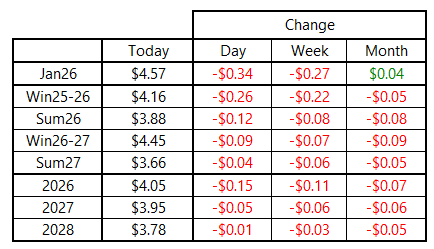

Bearish momentum continued to build today, as natural gas futures posted a second straight day of steep losses on the front of the forward curve. Prices were lower across the board, but the brunt of the weakness was felt in the January 2026 and other balance-of-season contracts. The remaining Winter 2025-26 strip finished Tuesday nearly 80 cents below the intraday high traded Friday morning. Summer 2026 was down as well, though by less than half of the daily losses experienced in the front three months on the curve. With the exception of the January contract, the entire curve has reset back to below month-ago levels.

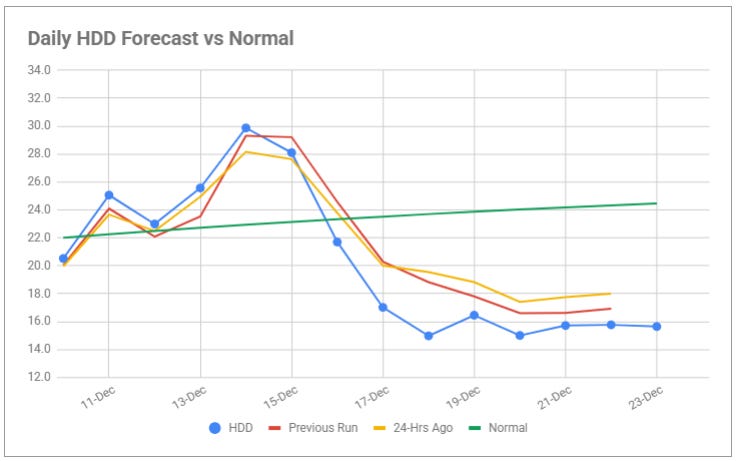

While model runs continue to confirm and even intensify the major cold snap that is set for the 6-10-day period, more agreement is being reached on a subsequent warmup beyond the middle of the month. In its latest run, the ECMWF-ENS model now shows population-weighted heating degree days falling well below normal beginning around December 17, with mild weather projected to persist through at least the 23rd.

Last week’s bullish price action seemed to be based on fears that the next cold snap would persist through the end of December, but with new data now showing the contrary, the market is swinging violently in the other direction. This is a clear illustration of the kind of volatility that can become commonplace in the futures market when the underlying fundamental balance is relatively tight, exacerbating the impact of weather-driven demand swings.

However, end users should remain cautious. As quickly as the sentiment flipped to bearish, ad indication of a return of colder-than-normal weather to key population centers could swing the pendulum sharply back in the other direction with no notice. With the lion’s share of the winter still ahead, volatility doesn’t look like it is poised to fade anytime soon.

An archive of Daily Natural Gas Market Notes can be found here.