Natural Gas Market Note | 12.08.2025

Natural gas gives up most of last week's gains.

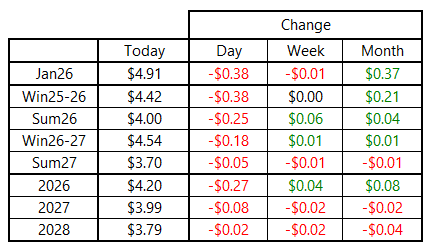

After rallying sharply last week, natural gas futures posted steep declines near the front of the curve on Monday. The market responded to a warming trend on the back end of the 14-day forecast by selling off and erasing most of last week’s gains. The prompt-month contract and the remainder of the Winter 2025–26 strip both reverted to week-ago levels, while the Summer 2026 strip remains marginally higher than last Monday’s close.

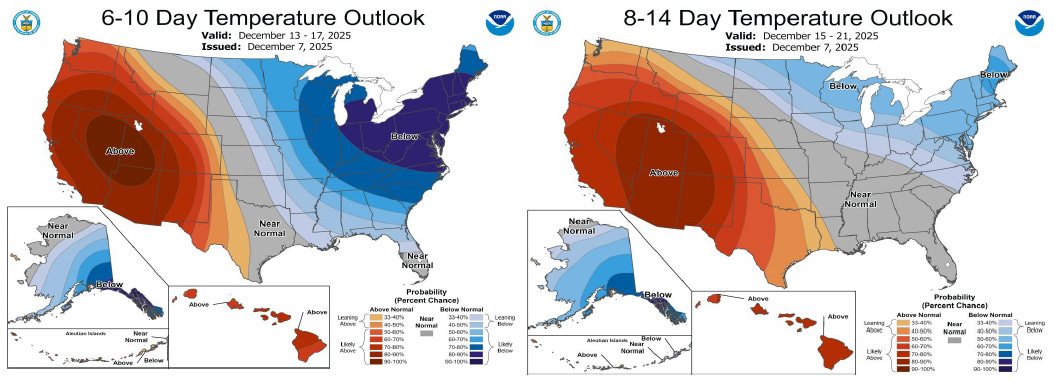

Momentum already looked like it might be fading on Friday when prices settled well off the intraday highs, and warmer model runs over the weekend further deflated the market’s bullish sentiment. To be clear, forecasts are not calling for exceptionally mild weather, but any relief from the major cold shot late last week — and the follow-up snap expected later this week — is a welcome change for the market. The 6–10-day forecast looks exceptionally cold in the Upper Midwest and Northeast, while the 8–14-day period still shows cooler-than-normal conditions but with notably softer anomalies.

Some models are beginning to suggest a more significant pattern shift beyond the two-week timeframe, but confidence remains low. If the market receives more confirmation of an unseasonably mild finish to December, sentiment in the futures market could shift more materially.

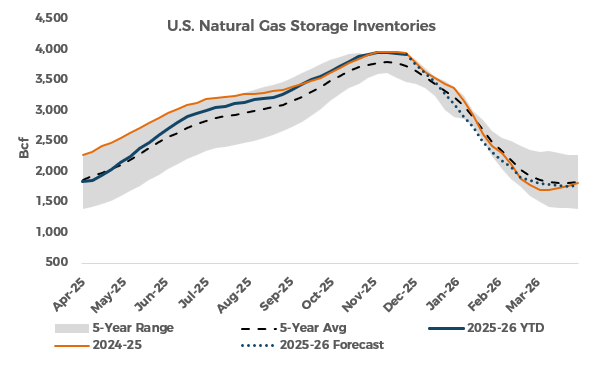

This Thursday’s storage report is expected to show the largest withdrawal of the season by a wide margin. Estimated supply and demand data from last week points to the potential for a draw near 200 Bcf, though most analysts remain reluctant to go that high and are calling for something closer to 170 Bcf. In any case, the next several reports are likely to show outsized withdrawals versus historical benchmarks, tightening the market by bringing inventories closer to the five-year average and widening the deficit to year-ago levels heading into month-end.

An archive of Daily Natural Gas Market Notes can be found here.