Natural Gas Market Note | 12.05.2025

Futures rally sharply amid major early-season cold snap.

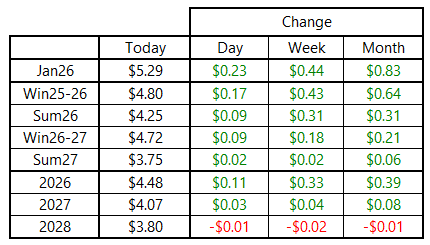

Natural gas futures surged to new highs today, with the prompt-month January 2026 contract trading as high as $5.496 per MMBtu before settling at $5.29, well off the intraday peak. The contract spanned a nearly 47-cent range and finished roughly in the middle of it. Gains and volatility were both less pronounced further along the curve, although the remaining Winter 2025-26 and Summer 2026 strips each posted new multi-month highs.

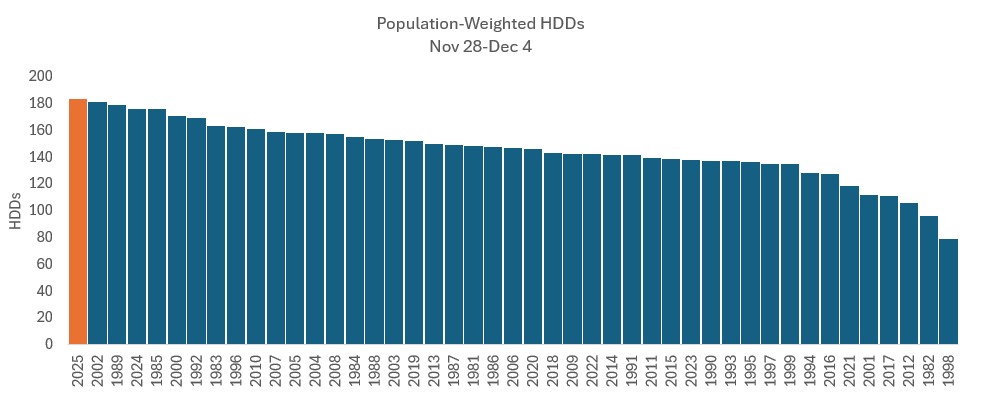

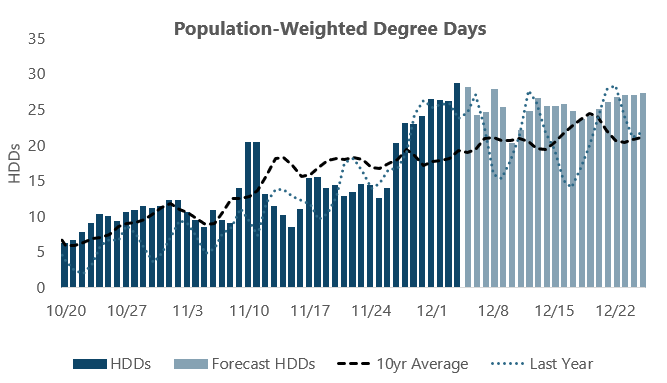

The market appears to be bracing for a major seasonal storage drawdown. Temperatures over the past week have been historically cold, with population-weighted heating degree days (HDDs) from November 28 through December 4 exceeding any comparable stretch in at least 40 years. While the absolute HDD totals this early in the season are still well short of major January or February cold snaps, the fact that conditions are running this cold this early has the market on edge about what the remainder of winter may bring.

It would be one thing if this were shaping up as an isolated event in an otherwise mild pattern, but that does not appear to be the case. Forecasts for the next two weeks continue to show lingering cold across the populous Midwest and East Coast, with some indicators pointing to an especially intense cold shot developing in late December. Midday model runs did moderate somewhat, helping futures ease off the highs, but the broader outlook remains firmly colder than normal for the foreseeable future.

An archive of Daily Natural Gas Market Notes can be found here.