Natural Gas Market Note | 12.03.2025

January futures settle just below $5.00 as temperatures drop.

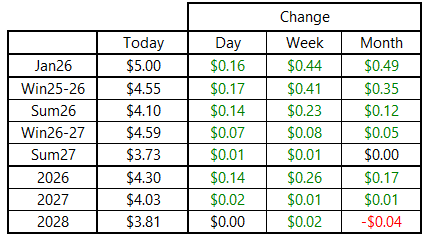

Natural gas futures resumed their uptrend today, with winter futures pushing to new highs and Summer 2026 also notching notable gains. The balance-of-winter strip ended the day at the highest level since July after breaching resistance near $4.50 per MMBtu that had held firm in recent days. The Summer 2026 strip saw its steepest daily gain since April, rising by nearly 14 cents to break firmly back above $4.00 and settle in line with the November intraday high near $4.10 per MMBtu.

The prompt-month January 2026 contract closed less than a penny below $5.00 per MMBtu after trading as high as $5.039 during the session. A prompt-month NYMEX contract hasn’t breached the $5.00 level in nearly three years, dating back to the retreat from the extreme highs of 2022.

Today’s price action came ahead of what is expected to be the coldest stretch of the season on a population-weighted basis. Tomorrow and Friday are forecast to deliver heating degree day (HDD) totals more typical of mid-January. Estimated residential and commercial demand has already reached new seasonal highs above 50 Bcf per day this week, but those volumes should increase materially as intense cold moves into key population centers in the coming days.

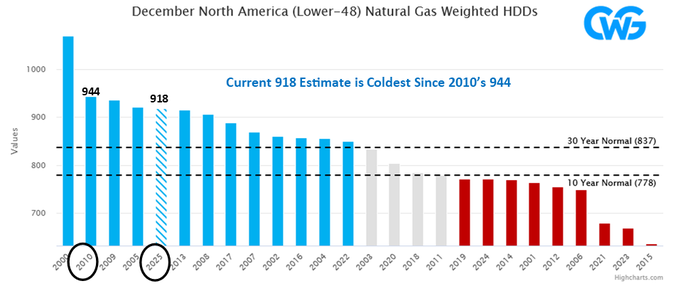

Forecast updates for the remainder of the month continue to trend colder as well. Commodity Weather Group’s (CWG) latest HDD outlook now shows December 2025 tracking as the coldest since 2010 and coming in nearly 18% colder than the 10-year normal. The 2013–14 season was the most impactful winter in recent memory for U.S. energy markets, and CWG is calling for this month to eclipse December 2013 in HDDs. Comparisons to Winter 2013-14 are gaining traction and contributing to increasing bullish sentiment.

Tomorrow’s government storage report is expected to show a withdrawal near 14 Bcf, according to a Wall Street Journal survey of analysts. The consensus masks a wide range of expectations, from a draw as large as 30 Bcf to a build of 22 Bcf. While a 14-Bcf pull would fall short of the five-year average and widen the surplus to that benchmark, the market is already looking ahead to next week’s report, which should reflect a much more substantial draw.

An archive of Daily Natural Gas Market Notes can be found here.