Natural Gas Market Note | 12.02.2025

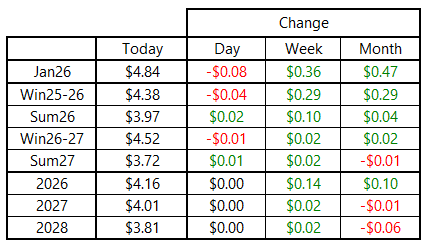

January & February futures pull back while the rest of the curve holds relatively steady.

The natural gas rally cooled off—at least temporarily—on Tuesday, as the January 2026 contract gave back yesterday’s gains, sliding $0.081 per MMBtu on the day. February slid by about half that amount, while the rest of the curve was only changed by one or two pennies. The balance-of-season strip appears to be running into resistance below $4.50, while the January contract’s momentum faded as it approached the $5-per-MMBtu benchmark.

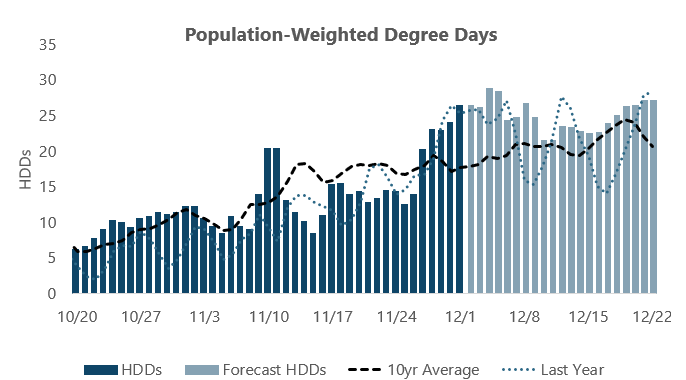

Weather model runs were little changed today, with cold still expected to peak on December 4 and 5 and temperatures poised to remain cooler than normal deep into the month. This idea is likely already built into pricing, but if cold intensifies beyond this week or looks to extend into late December, it could be a catalyst for another break to the upside.

Estimated domestic production continues to hit new record highs, which is helping to keep pricing at least somewhat in check as we move deeper into the winter. Recent daily estimates have output nearing 111 Bcf per day. Perhaps more importantly, estimated volumes have remained over 110 Bcf per day for nearly two weeks, which is above the top of the 2025 range. This is an indication that this new output has staying power and could represent the beginnings of the type of wholesale production growth that the market has been missing so far in 2025.

On the other side of the coin, LNG export demand has hit new record highs as well, with feedgas volumes reaching 20 Bcf per day for the first time. With all of the nation’s existing liquefaction capacity running close to capacity, further upside is structurally limited until Golden Pass ramps up to more material volumes later in the winter.

With LNG exports soaking up the production overhang, the market remains susceptible to weather-related risk this winter even in a record-supply environment.

An archive of Daily Natural Gas Market Notes can be found here.