Natural Gas Market Note | 12.01.2025

Natural gas adds to Friday's gains as cold weather outlook extends through mid-month.

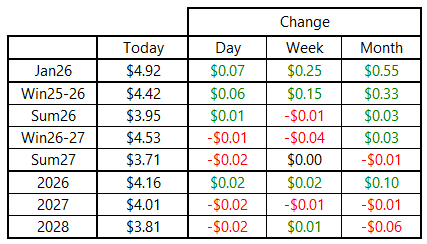

Natural gas futures covering the balance of winter added to the recent rally today. The market rallied sharply last Friday in an abbreviated trading session, with the January 2026 contract adding nearly $0.30 per MMBtu on the day. Rather than revert to pre-holiday levels as trading activity returned to normal, prices continued to gain ground after reversing higher from losses earlier in Monday’s trading session. The January 2026 contract finished the day above $4.90 per MMBtu for the first time since July, while today marks the first time that the prompt-month NYMEX contract has exceeded that level since December 2022.

While the January contract exceeded its November highs today, the same cannot be said for the balance-of-season strip as a whole. The Jan–Mar strip finished the day near $4.42 per MMBtu, up on the day but still short of the November 13 high of $4.48 per MMBtu for that group of contracts. This continues the trend of the biggest price swings occurring on the very front of the forward curve, with most of the volatility driven by near-term temperature forecasts.

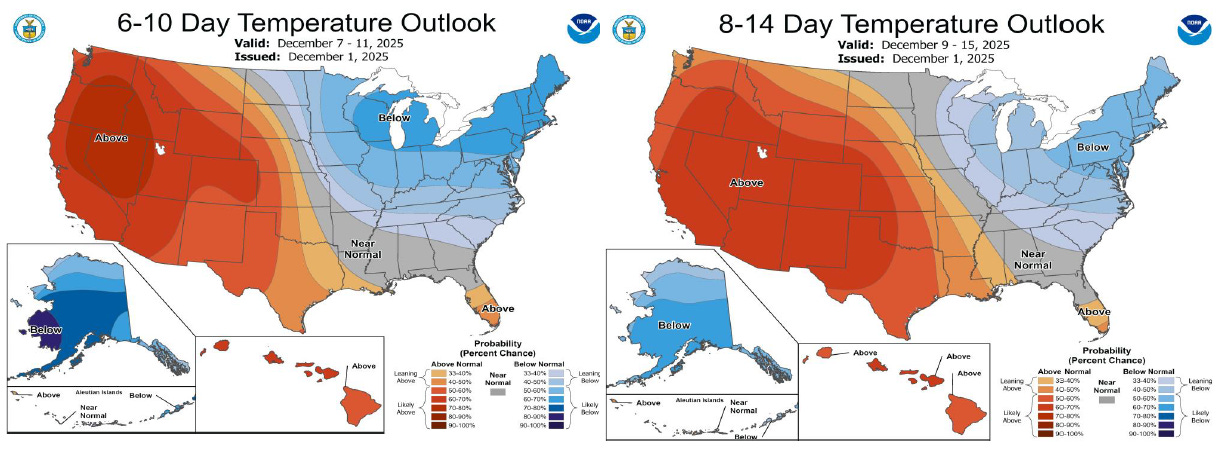

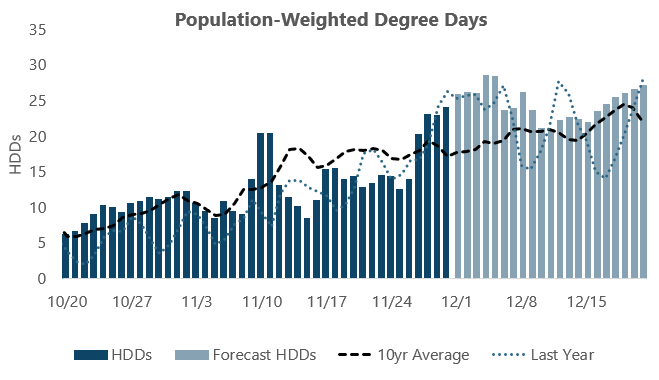

The latest model runs show further progression of the cold that has been in the forecast for the past two weeks. Current outlooks show December 4 and 5 as the two coldest days of the 14-day forecast, with population-weighted heating degree days reaching levels that don’t normally occur until much later in the season. This early shot of cold is poised to abate, but temperatures are expected to remain cooler than normal on average through at least mid-December.

Today’s price action was bolstered as some indicators began to point toward yet another significant cold shot hitting the continental U.S. around December 13. While that is currently far from a certainty, the market seems to be taking any indication of major cold very seriously at this point in the season.

Early indications for the upcoming storage report support the potential for a late net injection, as temperatures during the report week were relatively tame and demand dipped due to the holiday. However, early forecasts also showed a build for last week’s report, but the actual number was a net decline. In any case, we expect little change in the inventory situation this week prior to a very significant draw in the following report covering the week ending Friday, December 5.

An archive of Daily Natural Gas Market Notes can be found here.