Natural Gas Market Note | 11.25.2025

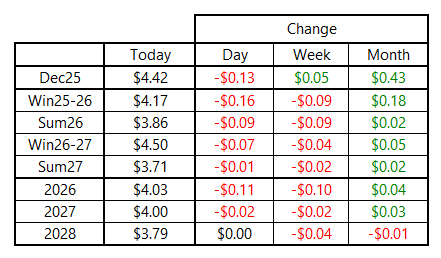

December falls into expiration, leading the rest of the curve lower.

NYMEX futures were down sharply today surrounding the December 2025 contract expiration. December traded mostly higher during its run on the front of the forward curve but ultimately gave up ground on expiration day, rolling off the board at $4.424 per MMBtu. The expiration price was about $0.26 off of its monthly high near $4.69 per MMBtu and about $0.63 above the intraday low traded on October 30, its first day as the prompt month.

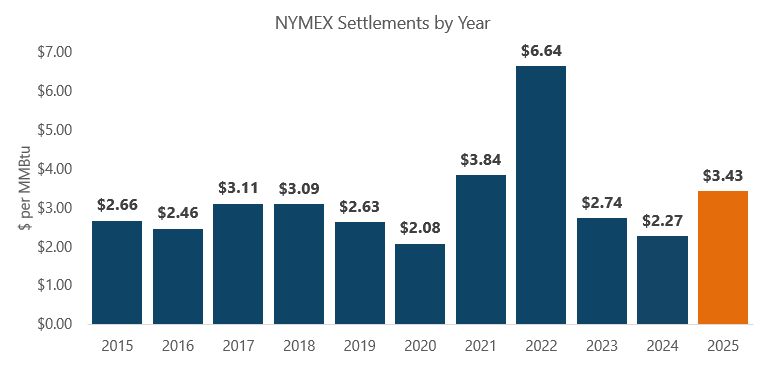

This was the highest NYMEX contract expiration since January 2023 rolled off at $4.709 per MMBtu. Calendar 2025 NYMEX is now in the books, having averaged $3.427 per MMBtu, which is the highest since 2022 and the third highest of the past 10 years. This represented an increase of more than 50% compared to average settles in 2024.

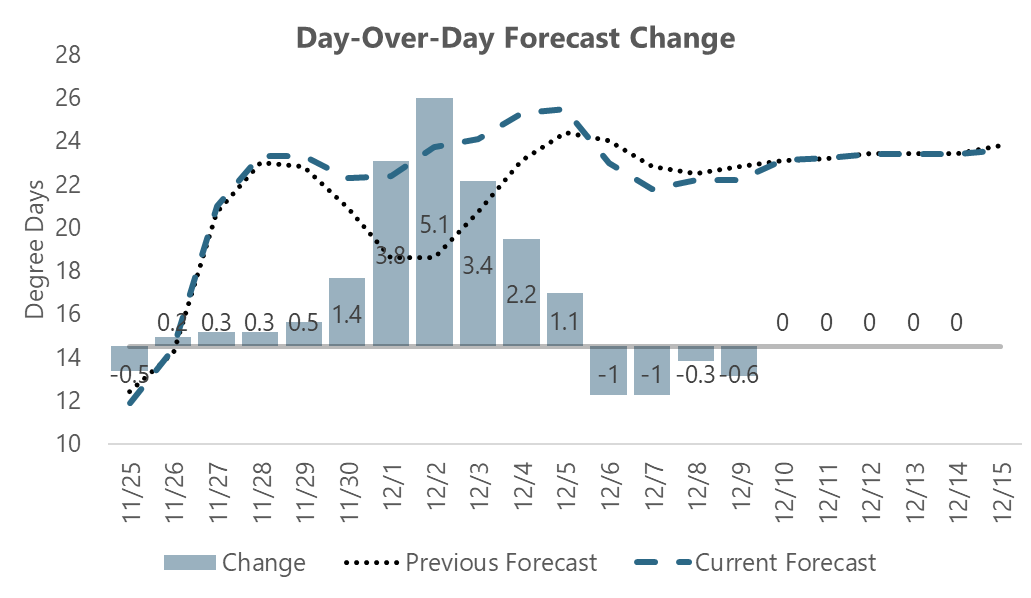

Counterintuitively, today’s sharp move lower came on the heels of significant colder shifts in predictive weather models compared to yesterday. What had previously looked like a brief moderation after the weekend cold snap is no longer in the forecast. Instead, the first three days of December were revised colder, and the forecast now depicts more of a steady ramp without the respite.

Tomorrow’s storage report is expected to show the slimmest of net builds for the week ended November 21, according to a Wall Street Journal survey of analysts. The average estimate came in at a build of just 1 Bcf, with responses ranging from an 11-Bcf draw to a build of 12 Bcf. The five-year average and year-ago benchmarks both show small withdrawals for the same week, so any injection would improve storage levels comparably.

An archive of Daily Natural Gas Market Notes can be found here.