Natural Gas Market Note | 11.20.2025

Prices give up some of yesterday's gains surrounding an "as expected" storage report.

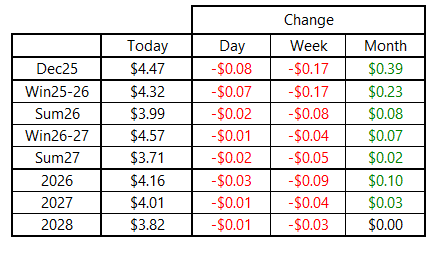

Natural gas futures finished lower across the board after a back-and-forth day of trading that saw the announcement of the first storage withdrawal of the season and minimal changes to near-term weather forecasts. Futures rallied sharply on the front of the curve yesterday, and today gave up roughly half of those gains. For the second straight day, the market was very little changed beyond March 2026.

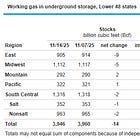

The biggest headline of the day was the EIA storage report, which showed a withdrawal of 14 Bcf for the week ended November 14. Inventories typically grow during this week, as indicated by the 12-Bcf build in the five-year average and the 3-Bcf addition in year-ago inventories. However, the brief cold snap that impacted the populous Midwest and East early in the report week was enough to tip the scales and lead to a net drawdown.

Today saw only modest adjustments to near-term temperature outlooks. Models are in general agreement surrounding next week’s shift to a colder pattern across most of the country, although some midday runs did back off a portion of the cold expected to impact the eastern half of the U.S. late in the 14-day period.

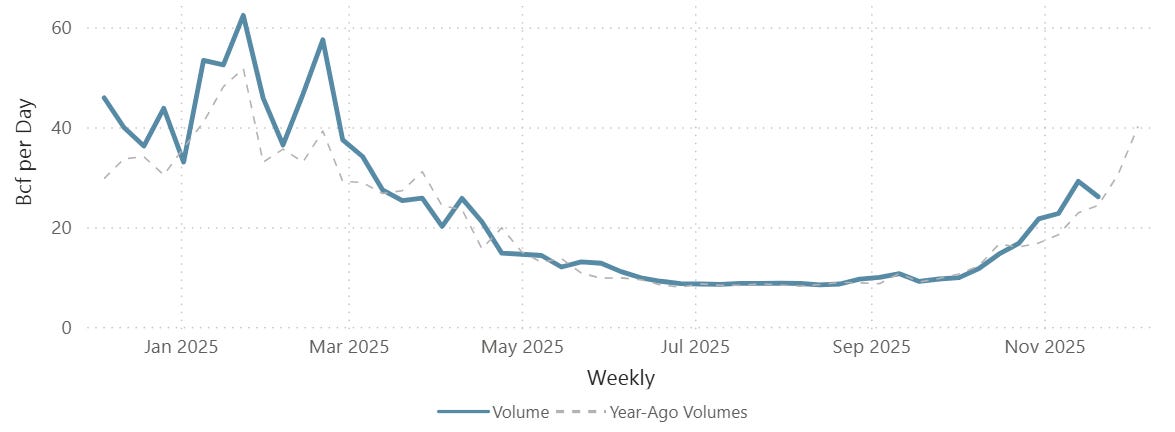

Domestic natural gas demand is lower across the board, week over week. Estimated consumption from the residential and commercial sectors is down by about 3 Bcf per day from the previous week, with power generation demand backing off to a lesser extent. However, space heating needs are expected to pick up substantially beginning on 11/27 and remain elevated into what is expected to be a colder-than-normal December.

Residential/Commercial Natural Gas Demand

An archive of Daily Natural Gas Market Notes can be found here.