Natural Gas Market Note | 11.19.2025

Futures push sharply higher again as forecasts progress colder.

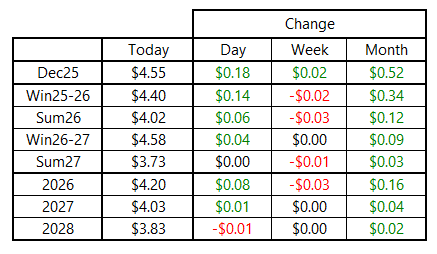

After yesterday’s impressive intraday recovery, momentum coming into Wednesday was on the bullish side, and prices moved accordingly. Winter futures rallied back to within about a dime of last week’s highs, gaining back all of Monday’s steep losses and then some. Gains were heavily concentrated on the front of the forward curve, with December finishing $0.18 per MMBtu higher and the balance-of-season strip finishing up $0.14 on the day. Seasonal strips for Summer 2026 and Winter 2026-27 were up marginally, while the curve was virtually flat beyond March 2027.

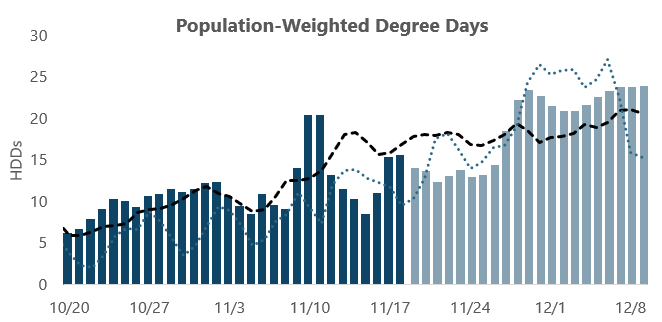

Colder revisions to near-term temperature forecasts were the primary driver behind today’s price action. The warm trend that most of the nation is currently enjoying looks like it will begin coming to a close next week, giving way to another significant cold snap over the holiday weekend.

Population-weighted heating degree days (HDDs) are poised to begin increasing on Thanksgiving and ramp up through Sunday, November 30. Temperature patterns are expected to moderate a bit from there, but cooler-than-normal weather is currently forecast to persist into the first week of December. The cold expected to start next Thursday will be more intense than what was observed early last week and also looks to have more staying power than that two-day event.

Because of that brief cold snap, tomorrow’s EIA report is expected to show the first net withdrawal of the winter season. The Wall Street Journal survey of analysts showed a consensus for a 14-Bcf draw for the week ended November 15. Estimates ranged from a draw of 7 Bcf to 25 Bcf. This would reduce the surplus to the five-year average and increase the deficit to year-ago storage, as both benchmarks posted a net build for the same week.

An archive of Daily Natural Gas Market Notes can be found here.