Natural Gas Market Note | 11.17.2025

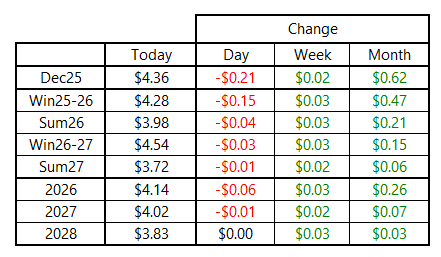

Natural gas futures retreat amid return to mild weather.

NYMEX natural gas deliverable through the remainder of winter finished sharply lower today, marking the second straight day of losses. This is the first two-day losing streak for winter futures in nearly a month. The prompt-month December contract led the way lower, losing 21 cents compared to a 15-cent drop on the four-month Balance-of-Winter strip.

December’s premium over February is back to about $0.07 per MMBtu after widening to about $0.15 last week. Under most normal forward market conditions, December should trade at a discount to February, which is an inherently riskier month for the natural gas market.

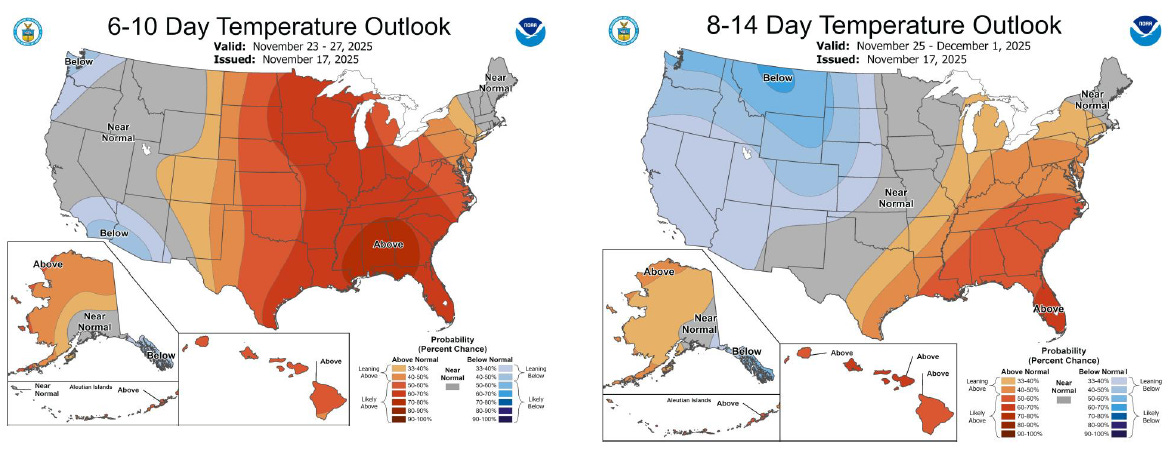

Today’s price action was especially volatile. The market opened Sunday evening considerably lower than Friday’s settlement, but by mid-morning, it looked as if prices were poised to potentially turn higher, as most of the overnight losses had been gained back. However, mid-day weather model runs backed off some of the forecasted return to cold in the 11-15-day period, helping to renew bearish momentum. The market began pushing consistently lower starting around 10am Eastern and settled near the daily lows.

The coming days will be indicative of whether this pullback is the beginning of a more meaningful correction to the recent rally or just a temporary move to help ease the overbought market condition. Traders will no doubt keep reacting quickly to any substantial change in near-term temperature outlooks as the winter continues to ramp up.

An archive of Daily Natural Gas Market Notes can be found here.