Natural Gas Market Note | 11.11.2025

Natural gas continues rally, pushing to new highs on the front of the curve.

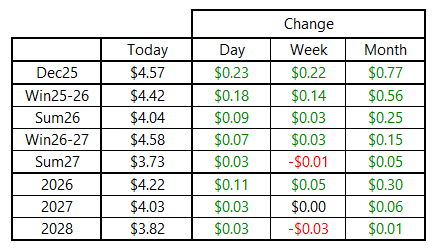

Prompt-month natural gas rallied to fresh highs today, with the December 2025 contract posting a daily settlement of $4.57 per MMBtu. This represents a nearly 4-month high for the December contract and is the highest daily close for prompt-month NYMEX since late 2022. The remainder of the Winter 2025-26 strip rallied sharply as well, although not quite to the same extent as the front month. Summer 2026 and beyond saw contracts finish higher on the day as well, with gains diminishing further out the curve.

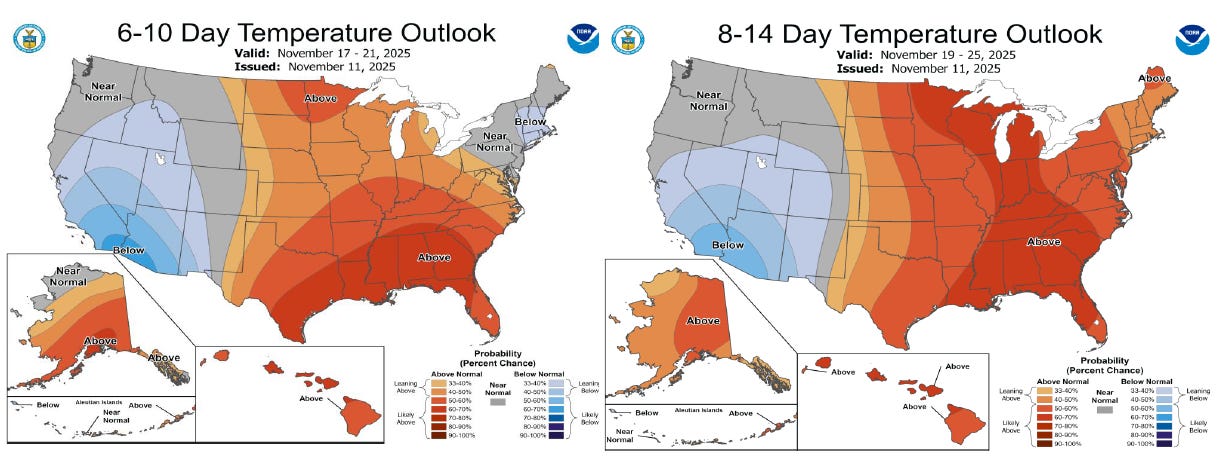

Today’s price action underscores the pervasive bullish sentiment that has dominated the marketplace since late October. Temperature forecasts showed slight strengthening in heating degree days compared to yesterday, with recent atmospheric developments conducive to a weaker warming pattern for the populous Northeast. Still, beyond today, temperature patterns are shifting to a largely warmer-than-normal regime across most of the U.S., which should work to limit natural gas demand through at least mid-month.

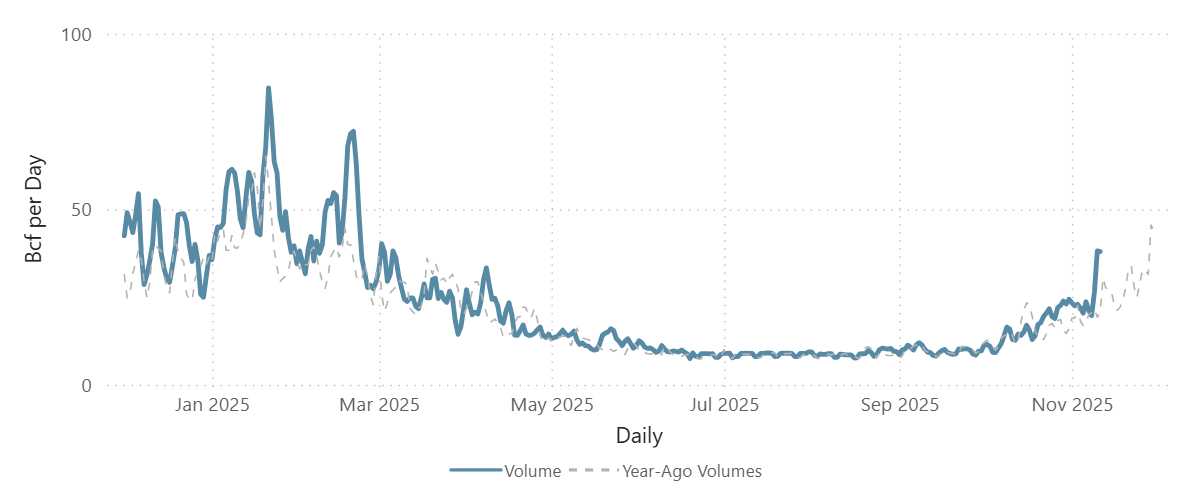

Estimated residential and commercial consumption hit 38 Bcf yesterday and today, which is the highest reading since early March and levels more typical of late November and early December. For reference, these sectors had been averaging between 20 and 23 Bcf per day prior to the cold snap, so the recent readings were a dramatic jump in a very short period of time. These volumes are a far cry from the 50+ Bcf per day that can be achieved during peak winter months, but this is a reminder how quickly natural gas demand can spike during cold weather events.

Residential & Commercial Natural Gas Demand

An archive of Daily Natural Gas Market Notes can be found here.