Natural Gas Market Note | 11.10.2025

Gas futures finish well off of overnight highs.

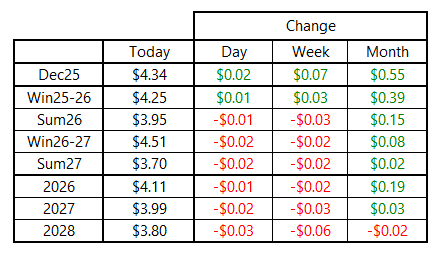

The December 2025 contract as well as the rest of the balance-of-winter strip finished marginally higher today, but the daily settlement came in well below the overnight highs. The market gapped higher at open Sunday evening, with December commencing trading at $4.48 per MMBtu and traded just above $4.50 at the highs overnight. However, as volume picked up this morning, the market traded back lower, closing the opening gap and dipping into negative territory before recovering to finish just above flat on the day.

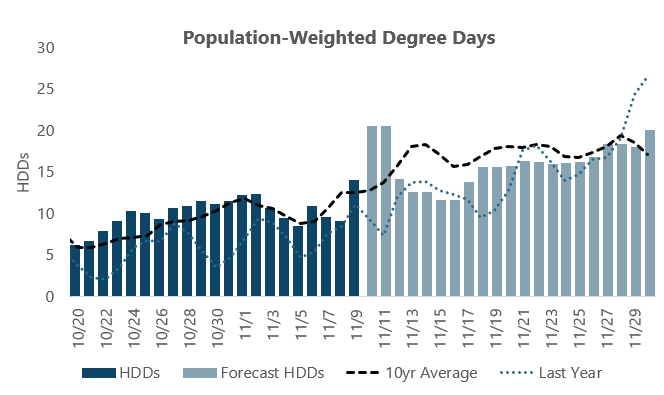

The market ramped up sharply in recent weeks, with the most recent rally seemingly driven by the anticipated cold weather event this week. Indeed, today and tomorrow currently look to be the coldest two days for the remainder of the month according to current outlooks, with temperatures set to moderate significantly for the rest of the week. However, since Friday, we did see some cooler revisions to the back end of the 14-day outlook, which could mean increased heating load for next week as well.

This Thursday’s storage report is expected to show a slightly larger injection than the 33-Bcf build announced for the final week of October. The upcoming report covering the week ended November 7 should show a build near 40 Bcf, which would be nearly in line with the five-year average build of 35 and the year-ago build of 45 Bcf for the same week. From there, a net withdrawal is anticipated for the second week of the month.

An archive of Daily Natural Gas Market Notes can be found here.