Natural Gas Market Note | 11.07.2025

NYMEX gas finishes higher for the third straight week.

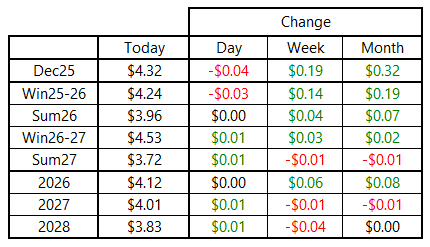

Natural gas futures were modestly lower across the front of the forward curve on Friday, but the market finished the week in positive territory. This marks the third straight week of gains for prompt-month natural gas, which is the longest such streak since February. Balance-of-Winter 2025-26 gave up 3 cents while the rest of the curve was virtually flat on the day.

More details on the week’s developments can be found in today’s Natural Gas Market Talk:

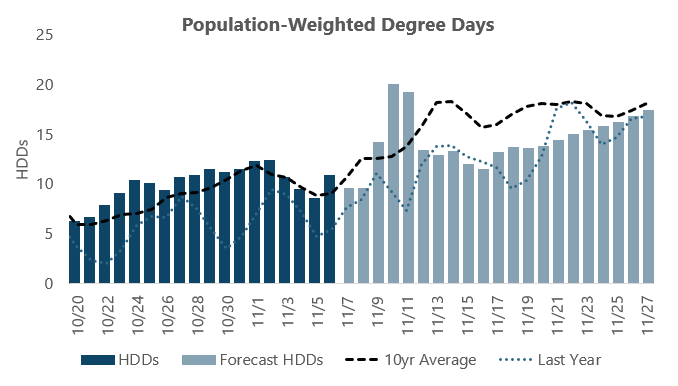

Today was relatively quiet as far as market driving news goes. Near-term temperature forecasts are little changed from yesterday, with traders still anticipating a significant cold weather event beginning on Sunday in the Midwest and moving into the East on Monday and Tuesday. This will drive the most robust residential and commercial demand so far this season and likely lead to a storage withdrawal for the week ending next Friday the 14th.

From there, temperatures are expected to shift warmer. According to the current outlook, November 10 and 11 will be the coldest two days of the month on a population-weighted basis. Obviously, this forecast can change, and the risk for more extreme cold is on the table for later in November.

While domestic production growth has been relatively stagnant for the past 5 months, we are seeing more signs of life on the drilling front. The Baker Hughes gas-directed rig count increased by 3 this week to 128, which is the highest since July 2023. While drilling activity is still down from 2022-23 highs above 160, the count has recovered nicely from last year’s lows south of 100. This is an indication that producers are shifting further into growth mode in anticipation of higher market pricing in 2026 and beyond.

An archive of Daily Natural Gas Market Notes can be found here.