Natural Gas Market Note | 11.06.2025

Natural gas recovers yesterday's losses.

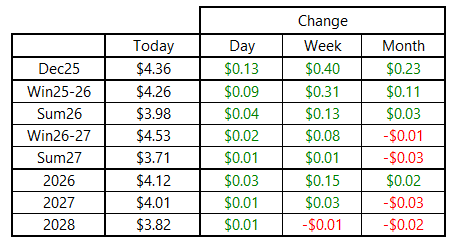

NYMEX pricing was back on the rise today, with the market recovering the majority of yesterday’s losses to return back near recent highs. December led the way, gaining 13 cents on the day, with losses tapering off as you get further out the curve.

The storage report provided a bit of support, as the 33-Bcf build came up shy of historical benchmarks. However, the number was largely in line with consensus market expectations and did not prompt a significant immediate price response. Inventories wrapped up the traditional injection season just above 3.9 Tcf with another net addition likely for next week’s report.

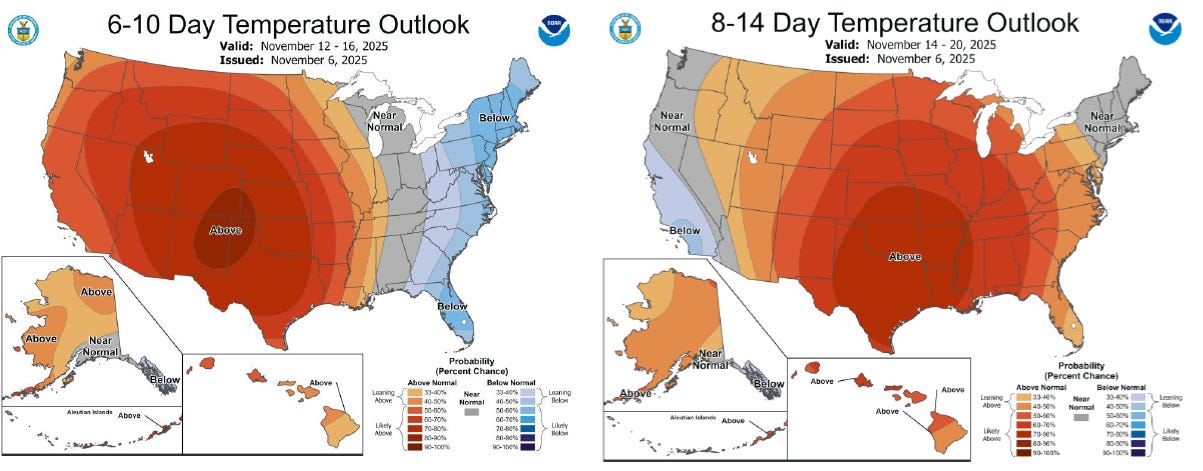

Beyond that, we are expecting a draw for the week ending November 14 due to the season’s first significant cold snap expected early in the week. Recent forecast updates have solidified these expectations and added heating degree days surrounding the heart of the cold event on Monday and Tuesday. The end of the two-week period still looks conducive to a warm up and a possible additional injection late in the month, but the inventory peak will likely be established as of November 7.

Meanwhile, bullish news continues to come out on the LNG front. FERC granted Golden Pass LNG approval to begin introducing hazardous fluids into the low-pressure flare system for ignition testing. This is yet another check mark on the way to that facility ramping up feedgas consumption during the commissioning phase of Train 1. On a longer-term note, it was reported that US LNG producers signed long-term contracts for the equivalent of 4 Bcf per day in 2025, further solidifying the future growth trajectory that could see exports virtually double in the next 5-6 years.

An archive of Daily Natural Gas Market Notes can be found here.