Natural Gas Market Note | 11.05.2025

Natural gas prices retreat across the curve.

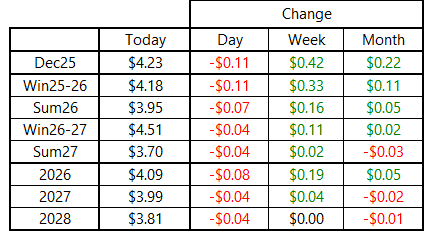

The four-day winning streak for NYMEX natural gas futures was broken today, with the prompt-month contract and balance-of-winter strip posting declines of $0.11 per MMBtu. Prices essentially reverted to where they sat on Monday afternoon and remain sharply higher than week-ago levels. Losses were less pronounced deeper out across the curve, but all contracts through at least 2029 delivery finished in the red on the day.

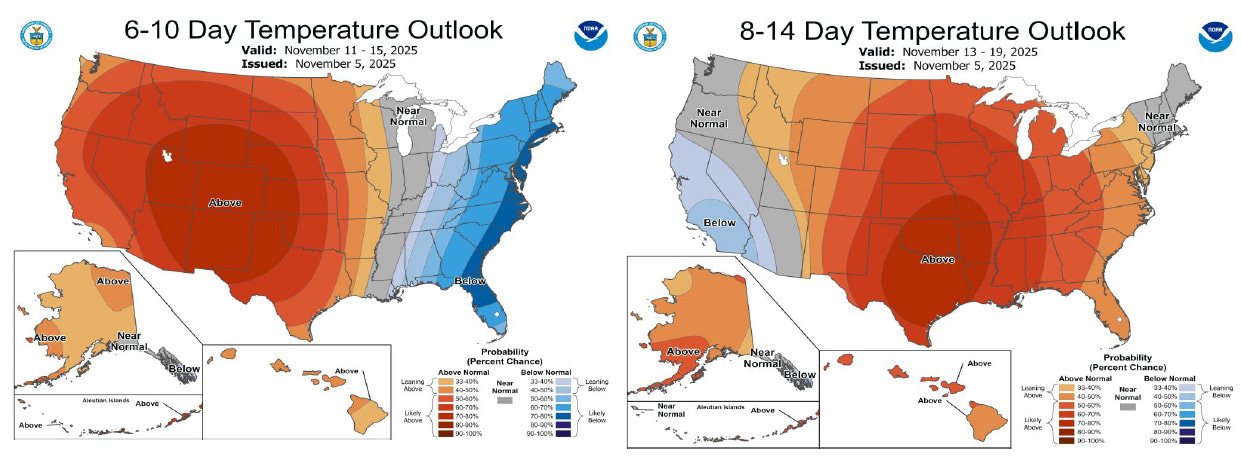

Temperature forecasts had been trending colder for early next week, and while the forecast has not materially changed, the lack of further progression in the cooler revisions likely helped let some of the bullish sentiment out of the market. It still looks as if Monday and Tuesday will see the coldest weather relative to normal and bring about by far the most significant heating demand of the season so far.

Market participants are forecasting a much smaller storage build for the final week of the traditional injection season. A Wall Street Journal survey of industry analysts pointed toward a build of 31 Bcf, with responses ranging from 25 to 35 Bcf. A 31-Bcf addition would bring inventories to 3,913 Bcf, with the build coming in less than half of the year-ago number and 11 Bcf shy of the five-year average for the same week. This would put inventories back at a slim deficit to 2024 to start the winter.

An archive of Daily Natural Gas Market Notes can be found here.