Natural Gas Market Note | 11.04.2025

Natural gas futures remain strong, posting gains for the fourth straight day.

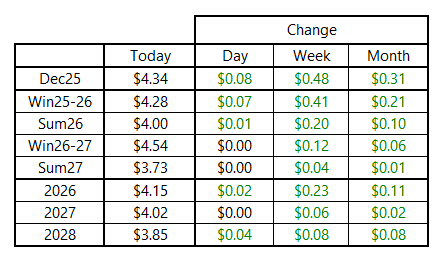

Upward momentum persisted in the natural gas market today, with the balance of Winter 2025-26 posting its fourth straight day of gains to settle near $4.28 per MMBtu. This marks the highest daily settlement for the diminishing strip since July 21. The rest of the curve was virtually flat through 2027, with Calendar 2028 rising to narrow the discount to the 2027 strip.

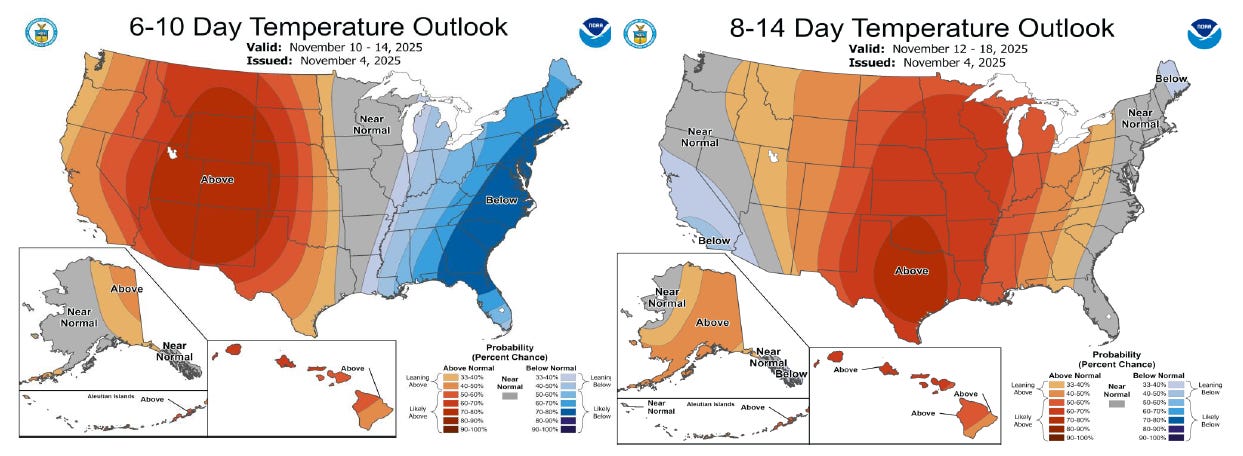

Market participants continue to react to revisions to near-term temperature outlooks. We continue to see the forecast for early next week trend colder, with Monday and Tuesday now expected to be dramatically cooler-than-normal across the populous eastern half of the U.S. This outlook increases the probability of a net storage withdrawal for the second week of November. Temperatures are expected to warm from there, but the current pattern means that storage inventories are now much less likely to cross 4.0 Tcf.

On the storage front, the market is anticipating a much smaller injection for this Thursday’s report. Early forecasts are pointing to a build in the 30s for the U.S., while indications from Dominion and TCO are pointing toward a potential net withdrawal in the East. A 35-Bcf build would be 10 Bcf shy of the five-year average, while coming in at less than half of the build reported during the same week in 2024.

An archive of Daily Natural Gas Market Notes can be found here.