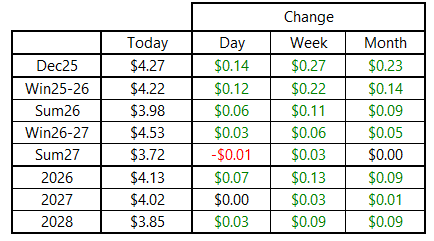

Natural Gas Market Note | 11.03.2025

Natural gas futures continue to push higher on cooling forecasts.

Natural gas posted its third straight day of gains since December rolled to the front of the forward curve. Prices initially relaxed from overnight highs and the market was flat for most of the morning. However, upside momentum began mounting midday and peak winter contracts all finished the day with double-digit gains. The Winter 2025-26 strip posted its highest daily settlement since July, finishing the day just below $4.22 per MMBtu.

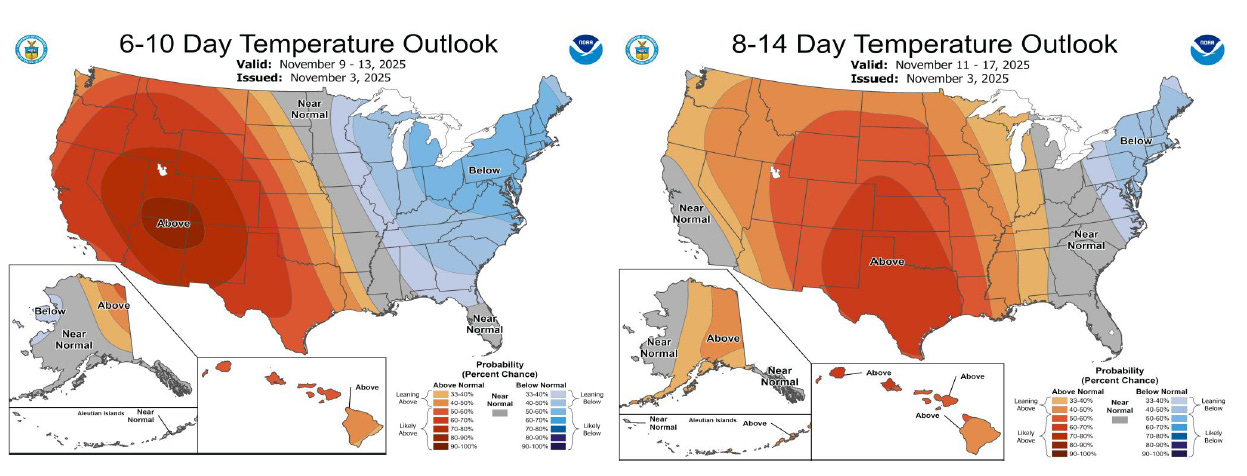

Near-term forecasts have shifted colder since late last week, with the 6-10 and 8-14-day outlooks now showing cooler-than-normal temperature conditions for the populous eastern half of the U.S. The 6-10-day period in particular has moved significantly to the cold side, adding population-weighted heating degree days for the first half of next week. The most intense anomalies relative to normal are expected from November 9th through the 11th.

Estimated LNG export volumes relaxed a bit from Friday’s record highs, but feedgas remains strong as residential and commercial demand picks up. Flows into Corpus Christi surpassed 3 Bcf per day for the first time on record over the weekend as operations continue to ramp at the modular Phase 3 expansion. Meanwhile, combined residential and commercial demand crossed above 23 Bcf per day for the first time since early April. Based on current temperature forecasts, we could see net withdrawals start during the second half of November, which would likely prevent inventories from crossing 4.0 Tcf.

An archive of Daily Natural Gas Market Notes can be found here.